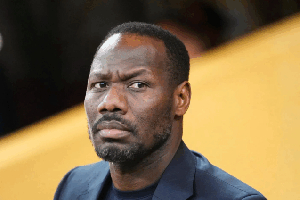

Vice President Kwesi Amissah-Arthur says it is about time central banks in the ECOWAS sub-region consider a deliberate policy to devalue their currencies if they are to make any tangible headway in meeting the key criteria for adopting a single currency by 2020.

The Vice President, speaking at the 35th Meeting of the Convergence Council of the West African Monetary Zone (WAMZ), complained about the lack of progress in processes that will lead to creation of a single currency.

“We continue to expend time and effort in holding meetings; 35 so far for the Convergence Council. Have meetings become an end in themselves?

“We have postponed establishment of the second monetary zone five times. Given the lack of clear progress on the substantive convergence agenda, do we still need a WAMZ agenda that is costing our taxpayers a lot of money with no end in sight,” Mr. Amissah quizzed at Friday’s meeting.

Suggesting the way forward, Mr. Amissah Arthur said sub-region leaders pursuing a regional economic bloc must be “innovative and confront dogmatic thinking”.

According to him, given the centrality of exchange rates in the convergence process, its volatility and transmission role in reserve accumulation, price formation and the fiscal deficit, there is probably an advantage for countries to enhance currency stability by devaluing.

“Will formal and discrete devaluation rather than creeping depreciation increase currency stability and resilience, thereby boosting convergence?” the Vice President said.

He said the leaders of various institutions mandated to put in place the structures that will see the introduction of a regional economic bloc have to identify ways of extending the successes chalked up in other areas of integration, such as peace and security, and apply the same commitment to the task of economic convergence and integration.

“It is also important for us to recognise that we can pursue institutional innovations based on the experience of others such as the Euro-zone. We need to design a stability mechanism, create a banking union, strengthen fiscal regimes in member-countries and improve information sharing and surveillance within the West Africa Monetary Zone,” Mr. Amissah Arthur said.

Abandoned dream

The dream of having a common currency, the ‘ECO’, for the English-speaking countries under ECOWAS by the West African Monetary Zone (WAMZ) began in 2000 -- but failed to materialise due to the inability of members to meet various performance benchmarks.

After a series of postponements, the ECO dream was finally suspended due to challenges relating to the slow progress toward convergence by member-countries, weak integration of convergence criteria and other WAMZ benchmarks in national development frameworks and plans, inadequate and dilapidated infrastructure, as well as weak productive capacities.

A Chief Economist at the West Africa Monetary Institute (WAMI), Dr. Christian Ahortor, said the presidential taskforce gave its blessing to the decision to abandon the ECO at the 45th Ordinary Session of ECOWAS held on July 10, 2014, in Accra.

All countries in the Economic Community of West African States (ECOWAS) sub-region are now expected to move to a single currency regime by 2020, after failed attempts to introduce the ECO for non-Francophone countries in the region.

The new single currency, which is expected to facilitate trade among countries, will be introduced after all the 15 countries in the sub-region meet an outlined convergence criteria and also see the establishment of the ECOWAS central bank.

ECOWAS countries are expected to meet four primary criteria for convergence including single-digit inflation; a fiscal deficit (excluding grants) of not more than 4.0 percent of GDP and 3.0 percent including grants; central bank financing of fiscal deficit of not-more-than 10 percent of the previous year’s tax revenue; and gross external reserves of not less-than 3.0 months of import cover.

There are six secondary criteria including a stable real exchange rate, a positive real interest rate, and the prohibition of new domestic default payments and liquidation of existing ones.

Business News of Monday, 18 January 2016

Source: thebftonline.com