The Licensed Cocoa Buyers Association of Ghana (LICOBAG) has raised serious concerns over the worsening financial plight of the cocoa sector.

The group said ongoing funding failures at the Ghana Cocoa Board (COCOBOD) have pushed Licensed Buying Companies (LBCs) to the brink of collapse and threatened the stability of the country’s cocoa industry.

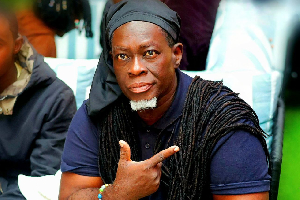

Speaking at a media briefing in Accra on Thursday, February 5, 2026, Executive Secretary, Victus Dzah, delivered a stark assessment of the sector’s financing challenges, tracing the crisis to the 2023/2024 crop season when COCOBOD failed to arrange its traditional syndicated funding of around US$1.3 billion, securing only US$500 million, and that, months after the season’s official start on September 8, 2023.

Dzah added that Licensed Buying Companies were compelled to pre-finance cocoa purchases with high interest facilities from commercial banks at a time when the Ghana Reference Rate was 29.8 per cent, in order to pay farmers.

In contrast, COCOBOD’s first payment for cocoa delivered to the ports did not come until January 26, 2024, six months later, leaving LBCs to bear the full cost of early purchases.

“This unfortunate development pushed all LBCs into huge debts, leading to the total collapse of many companies,” Dzah said.

He added that the lingering debt overhang continues to weigh heavily on surviving LBCs, while COCOBOD has yet to honour its commitment to compensate them for high financing costs.

Too much political interference - Licensed Cocoa Buyers lament

He further explained that in the 2024/2025 season, COCOBOD’s inability to raise any syndicated facility at all prompted the adoption of a novelty financing model known as the 60/40 model, under which off-takers were required to pre-finance 60 per cent of purchases through the Bank of Ghana, with the remaining 40 per cent paid upon final delivery of stocks to terminal points.

The arrangement was designed to ease cash flow but, according to Dzah, inadvertently weakened COCOBOD’s role in funding the industry because it lacked its own capital.

Dzah said the model had serious unintended consequences, with many LBCs left stranded without access to funding.

Others, he said, secured finance but could not find buyers to lift their stocks; while LBCs that did deliver cocoa to port were not paid early enough, exacerbating their debt servicing burdens.

He also linked funding inadequacies to a rise in smuggling of cocoa outside Ghana.

For the 2025/2026 season, which opened in August, the funding formula was revised to an 80/20 model, providing 80 per cent of upfront payments to LBCs for farmer payments and handling costs, with the remaining 20 per cent payable to COCOBOD on delivery.

However, Dzah said that many off-takers had stopped buying as early as November season either after meeting contract targets or because cocoa already delivered had not been paid for by COCOBOD, while others cited the high cost of Ghana cocoa.

The LICOBAG Executive Secretary further warned that unless sustainable financing reforms are introduced rapidly, the ongoing funding impasse will continue to undermine Ghana’s cocoa value chain and jeopardise the sector’s long-term viability.

SO/AE

Understanding Ghana's stock market and how to invest | BizTech

Business News of Friday, 6 February 2026

Source: www.ghanaweb.com