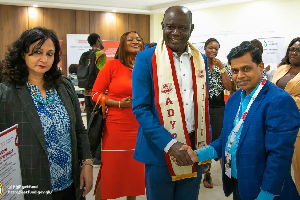

Substantive Finance Minister Dr. Mohammed Amin Adam, in his first visit to the Ghana Revenue Authority (GRA), urged swift action to increase domestic revenue collection.

Emphasising the crucial role of the GRA in achieving the government’s fiscal goals, Dr. Amin stressed the need for a coordinated and efficient approach to maximise revenue generation.

The Minister highlighted the importance of a clear roadmap for implementing tax measures.

“Some of the tax handles approved by Parliament are still awaiting implementation mechanisms,” he stated, stressing the need for a “clearly defined roadmap” to achieve targets and meet the country’s pressing needs.

He pointed out the critical role of exceeding revenue targets for the success of the IMF ECF program, warning of the “not good” consequences of failing to meet commitments.

Key Priorities and Digital Efficiency

Dr. Amin reiterated the key priorities outlined for the GRA, including cleaning the taxpayer register, migrating data to the e-tax portal, and operationalising key systems by December 2024.

He urged the GRA to leverage digital solutions to achieve operational efficiency, citing Estonia and India as examples of successful digital platforms for tax collection.

He highlighted the need for data integration across various sources like the Ghana card and DVLA to optimise revenue collection and curb tax evasion.

Combating Corruption

The Minister addressed concerns about corruption and unfriendly tax collection practices.

He acknowledged reports of “underhand dealings” and “exercise of discretion” against the state, urging the GRA to address these issues with renewed urgency.

He called for expanding the e-VAT mechanism and implementing faceless assessments to reduce human contact and improve the taxpayer experience.

He highlighted the need for a more citizen-friendly approach, citing examples where tax returns in other jurisdictions take as little as 5 minutes to file.

Dr. Amin pledged his personal support to the GRA, announcing plans to join officers at ports, airports, and border areas to understand their challenges and provide needed support. He expressed confidence in the GRA’s potential to exceed targets, stating, “I believe we can do more than the GH¢176.4 billion target.”

He assured the GRA of the government’s unwavering commitment to efficient spending and delivering value for taxpayers’ money.

On his part, GRA Commissioner General Dr. Ammishaddai Owusu-Amoah assured the nation of the Authority’s unwavering commitment to boosting revenue collection, even the ambitious targets set by the Finance Minister.

In response to Dr. Amin’s recent visit, Dr. Owusu-Ansah highlighted the GRA’s track record, citing four consecutive years of exceeding projections and steady growth.

“It’s the first time in our history that we have exceeded projections for four straight years,” stated the Commissioner General, emphasising the achievements despite challenging economic conditions.

"For instance, the year-on-year growth rates, including percentages during the beginning of the pandemic, followed by 16.5 percent, 26.5 percent, 31.5 percent, and 48.3 percent last year show that this continuous increase in growth rate is unprecedented,” he added.

Additionally, the GRA Boss said his outfit aims to surpass the GH¢146 billion target set in the budget. He explained their strategy of maintaining the minimum 50 percent growth rate established over the past years.

The Commissioner General expressed full commitment to the Minister’s initiatives, particularly digitalisation and taxpayer-friendly practices.

Dr. Owusu-Ansah emphasised the GRA’s focus on digitalisation and stakeholder collaboration. He stated that Ghana is among only five countries worldwide with automatic exchange of information on residents’ foreign accounts.

This achievement, he explained, showcases their digital infrastructure aligning with global standards. He added that countries like Rwanda are seeking to learn from their successful practices.

Business News of Thursday, 22 February 2024

Source: thebftonline.com

Finance Minister calls for urgent action to boost revenue mobilisation

Entertainment