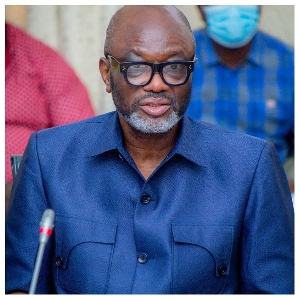

President of the Ghana Union of Traders Association (GUTA), Dr. Joseph Obeng has expressed optimism over the move by Vice President Dr. Mahamudu Bawumia to introduce a business-friendly flat tax rate regime.

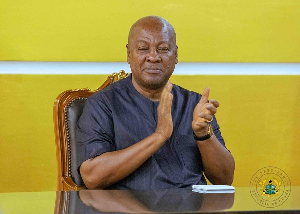

The NPP flagbearer, Dr Bawumia when during a public lecture on February 7, 2024 said his government, if given nod, would adopt a flat tax of a percentage of income for individuals and Small and Medium Enterprises SMEs (which constitute 98% of all businesses in Ghana) with appropriate exemption thresholds set to protect the poor.

“With the new tax regime, the tax return should be able to be completed in minutes! We will also simplify our complicated corporate tax system and VAT regime,” Dr Bawumia said.

Reacting to the development in an interview with Accra-based JoyNews, the GUTA president described the move as laudable as it will ease the cost of doing business in the country.

“When the VAT flat rate is implemented, it will ensure that all the leakages in the tax system are curbed and this is what the business community have been clamoring for. For instance, when the duty rate is flat, nobody can take advantage whether it is the agent, the trader or consumer as all parties will be aware of the flat rate to impose” the GUTA president said.

“The adoption of this policy is feasible as it is being adopted in other countries making them highly competitive in the market while Ghana’s climate remains uncompetitive because of the high rate on duties imposed on business” Dr Obeng added.

2/2

— NPP Projects Bureau (@BureauNpp) February 7, 2024

Bawumia speaks: I am overly excited because this is exactly what I want to hear. - Dr. Joseph Obeng, GUTA President.#BawumiaSpeaks pic.twitter.com/ZCtxomlT8D

MA/NOQ