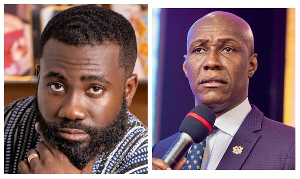

Mahama Ayariga, MP for Bawku Central has warned that if the Governor of the Bank of Ghana does not step in and seek legal clarity on the programme to support banks through the Ghana Financial Stability Fund (GFSF), the implementing agency; Ghana Amalgamated Trust PLC (GAT) will end up offloading the shares of the domestic banks to third parties. This will effectively end up in the expropriation of the interests of existing owners of our indigenous Ghanaian banks.

In a letter written by Mr. Ayariga to the Governor of the Bank of Ghana, the law maker raises concerns about what he says are the illegality and opaqueness of the operations of GAT and GFSF and how they could ultimately enable the take-over of our domestic banks by cronies of decision makers for the sector.

Mahama Ayariga has therefore called on both the Governor of the Bank of Ghana and Parliament to step in to ensure legal and policy clarity in terms of the intervention being made by Minister Ken Ofori-Atta to deal with the threats to the banking sector occasioned by the implementation of the Domestic Debt Exchange (DDE) programme.

“The Minister of Finance has announced a debt restructuring programme involving a debt exchange by government domestic bond holders. Our total external debt stood at about GHC383 billion as at November 2022. Domestic debt constituted GHC195 billion. Total debt was therefore GHC578 billion in November 2022.

“Banks in Ghana hold about half of the entire domestic bonds of the Government of Ghana and individuals hold 11% of the Government bonds. The Minister of Finance has compelled domestic banks to “voluntarily” engage in a debt exchange with the Government in relation to the bonds they hold. This involves reduced coupons and deferred payments. Definitely, the liquidity, solvency and capitalization of these banks will be negatively affected. This also creates a problem for the financial sector as individual investors will be scared. Coming after the recent banking sector “cleanup” and the collapse of some banks it generated, people will shy away from depositing their funds in bank accounts. Our entire financial sector is in danger of collapsing,” parts of the statement said.

The Minister for Finance has announced a Ghana Financial Stability Fund and directed banks to approach Ghana Amalgamated Trust PLC for a rescue package. This letter to the Governor and those copied seeks to point out the danger of this remedial prescription of the Minister for Finance.

NYA/WA

General News of Tuesday, 31 January 2023

Source: www.ghanaweb.com