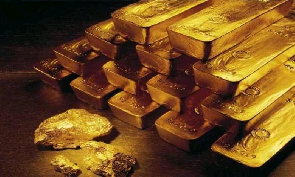

ABOUT GOLD

Gold is respected throughout the world for its value and rich history, which has been interwoven into cultures for thousands of years. Coins containing gold appeared around 650 B.C., and the first pure gold coins were struck during the rein of King Croesus of Lydia about 100 years later.

Ghana is the largest producer of Gold in Africa making it arguably a secure source of your gold supply for years. Since the price of gold is regulated internationally by conditions of supply and demand and geopolitics, the price of gold in Ghana is almost just as that on the international market but discounts could be provided in some situations.

Throughout the centuries, people have continued to hold gold for various reasons. Societies, and now economies, have placed value on gold, thus perpetuating its worth. It is the metal we fall back on when other forms of currency don’t work, which means it always has some value as insurance against tough times. Below are eight practical reasons to think about owning some gold today.

5 Major Reasons Investors are buying more gold in 2023

Buying gold from BMC (Bechicam Mining Company) is the safest fastest way to get high purity gold irrespective of your location in the World. Delivery to people in Ghana is within 48 hours of placing your order. Below are the reasons most investors and individuals are buying more gold from BMC;

• Gold is the best alternative when the local currency is weakening

• Great hedge against inflation

• Best protection against deflation

• Best product to diversify your portfolio

• Price moves up with increasing geopolitical uncertainty which is prevalent in our times.

Why Buying and Holding Gold is Valuable

Unlike paper currency, coins or other assets, gold has maintained its value throughout the ages. People see gold as a way to pass on and preserve their wealth from one generation to the next. Since ancient times, people have valued the unique properties of the precious metal.

Gold doesn’t corrode and can be melted over a common flame, making it easy to work with and stamp as a coin. Moreover, gold has a unique and beautiful color, unlike other elements. The atoms in gold are heavier and the electrons move faster, creating absorption of some light; a process which took Einstein’s theory of relativity to figure out.

Weakness of the local currency

Although the U.S. dollar is one of the world’s most important reserve currencies, when the value of the dollar falls against other currencies as it did between 1998 and 2008, this often prompts people to flock to the security of gold, which raises gold prices.

The price of gold nearly tripled between 1998 and 2008, reaching the $1,000-an-ounce milestone in early 2008 and nearly doubling between 2008 and 2012, hitting above the $2,000 mark.

The decline in the U.S. dollar occurred for a number of reasons, including the country’s large budget and trade deficits and a large increase in the money supply.

Inflation Hedge

Gold has historically been an excellent hedge against inflation, because its price tends to rise when the cost of living increases. Over the past 50 years investors have seen gold prices soar and the stock market plunge during high-inflation years.

This is because when fiat currency loses its purchasing power to inflation, gold tends to be priced in those currency units and thus tends to arise along with everything else. Moreover, gold is seen as a good store of value so people may be encouraged to buy gold when they believe that their local currency is losing value.

Deflation Protection

Deflation is defined as a period in which prices decrease, when business activity slows and the economy is burdened by excessive debt, which has not been seen globally since the Great Depression of the 1930s (although a small degree of deflation occurred following the 2008 financial crisis in some parts of the world).

During the Depression, the relative purchasing power of gold soared while other prices dropped sharply. This is because people chose to hoard cash, and the safest place to hold cash was in gold and gold coin at the time.

Geopolitical Uncertainty

Gold retains its value not only in times of financial uncertainty, but in times of geopolitical uncertainty. It is often called the “crisis commodity,” because people flee to its relative safety when world tensions rise; during such times, it often outperforms other investments.

For example, gold prices experienced some major price movements this year in response to the crisis occurring in the European Union. Its price often rises the most when confidence in governments is low.

Supply Constraints

Much of the supply of gold in the market since the 1990s has come from sales of gold bullion from the vaults of global central banks. This selling by global central banks slowed greatly in 2008. At the same time, production of new gold from mines had been declining since 2000.

According to BullionVault.com, annual gold-mining output fell from 2,573 metric tons in 2000 to 2,444 metric tons in 2007 (however, according to the U.S. Geological Survey, gold saw a rebound in production with output hitting nearly 2,700 metric tons in 2011.) It can take from five to 10 years to bring a new mine into production. As a general rule, reduction in the supply of gold increases gold prices.

Increasing Demand

In previous years, increased wealth of emerging market economies boosted demand for gold. In many of these countries gold is intertwined into the culture. In China, where gold bars are a traditional form of saving, the demand for gold has been steadfast.

India is the second largest gold-consuming nation in the world; it has many uses there, including jewelry. As such, the Indian wedding season in October is traditionally the time of the year that sees the highest global demand for gold.

Demand for gold has also grown among investors.

Many are beginning to see commodities, particularly gold, as an investment class into which funds should be allocated. In fact, SPDR Gold Trust, became one of the largest ETFs in the U.S., as well as the world’s largest holder of gold bullion as of 2019.

Portfolio Diversification

The key to diversification is finding investments that are not closely

correlated to one another; gold has historically had a negative correlation to

stocks and other financial instruments. Recent history bears this out:

• The 1970s was great for gold, but terrible for stocks.

• The 1980s and 1990s were wonderful for stocks, but horrible for gold.

• 2008 saw stocks drop substantially as consumers migrated to gold.

Properly diversified investors combine gold with stocks and bonds in a portfolio to reduce the overall volatility and risk.

In conclusion

Every individual who wants to be financially free or maintain a healthy financial balance should understand why its necessary to buy and hold gold in 2023. Gold should be an important part of a diversified investment portfolio because its price increases in response to events that cause the value of paper investments, such as stocks and bonds, to decline.

Although the price of gold can be volatile in the short term, it has always maintained its value over the long term. Through the years, it has served as a hedge against inflation and the erosion of major currencies, and thus is an investment well worth considering. Visit the BMC’s marketplace and buy gold at affordable prices including 5 grams at $315, 10 grams at $610, 100 grams at $6050, 250 grams at $15027 and 1 kilogram at $58790.

General News of Sunday, 22 January 2023

Source: Evans Obiri, contributor