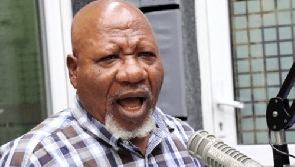

Ghanaian politician, Allotey Jacobs has claimed that owners of some of the banks which were closed in 2017 during the country’s financial sector clean up were engaged in money laundering.

He insists that, had their operations not been brought to an end, these banks would have caused severe heartaches amongst the Ghanaian populace.

“Some of the banks which were closed were engaged in money laundering. I will not mention names because some of them are my friends and I have invested with them. Their illegal activities started in 2015. The owners in these banks were living lavishly and were diversifying funds of their customers into other places and they lost our money,” he stated.

Allotey Jacobs who attacked the government when it started the financial sector clean up later had a change of heart after gaining insights into the exercise. “I didn’t understand government then but sometimes you have to be inquisitive and if I had not been curious, I wouldn’t have understood why the banks were closed.”

The social commentator who refused to name banks involved in the money laundering scheme motioned, “by their fruits, we shall know them and that is what happened to Nduom in America. It all borders on money laundering.”

He appealed to the government to make sure customers of these defunct banks get back their monies. “The government should make the sacrifice and refund monies to affected customers and not short-change them.”

On his accord, bank owners found guilty of money laundering should be prosecuted and sentenced so they serve as a deterrent to others.

The Bank of Ghana’s reforms has led to the collapsed of nine local banks, 347 microfinance institutions and some 23 finance houses.

On 1st August 2018, the Bank of Ghana announced the consolidation of the failed local banks, which included the Royal Bank, Beige Bank, Construction Bank, Sovereign Bank and Unibank. Later on, HBL and Premium Bank were added to the first five.

The collapse of the nine local banks birthed the state-owned Consolidated Bank Ghana (CBG) Limited.

More than 152,000 depositors have been affected since these Micro Finance Institutions, Savings and Loans Companies and banks were folded up for what the government described as their inability to meet liquidity standards.

General News of Tuesday, 25 May 2021

Source: happyghana.com