2020 was a rather bittersweet year for many people with many lows and some highs.

The business space in Ghana was not spared by some controversies amid the deals that raised eyebrows, red flags and others that even had to be halted.

Some of these controversial deals even caused political fallout for the country’s Special Prosecutor, the Auditor General among others.

Below are some of the controversial business deals of 2020.

Agyapa Royalties Deal

The passage of the Agyapa Royalties transaction agreement was one that became a major talk of the town in the business space.

Prior to approving the Agyapa Royalties transaction in 2020, Parliament in 2018 passed the Minerals Income Investment Fund (MIIF) Act 2018 which establishes the Fund to manage the equity interests of Ghana in mining companies and receive royalties on behalf of the government.

The deal which sought to use a Jersey-based special purpose vehicle would see almost 76 percent of the royalties generated from 16 large gold mines in Ghana under a scheme.

Additionally, some 49 percent of shares in Agyapa Royalties transaction are to be sold through a listing on the London Stock Exchange.

Following the approval, the Minority in Parliament, some Civil Society Organisations raised concerns over a lack of transparency surrounding the managers and beneficiaries of the deal.

Shortly after, the country first Special Prosecutor, Martin Amidu began a probe in the deal which resulted in a corruption risk assessment.

Martin Amidu in his report concluded there were major red flags in the deal particularly with breaches in the public procurement act and public financial management act.

He also noted the deal was susceptible to money laundering and possible bid-rigging in the contracting of advisors.

The Special Prosecutor and Presidency then began a back and forth of letters after it was alleged that President Akufo-Addo was tipped as the corruption kingpin by Martin Amidu.

On November 16, Martin Amidu resigned from his position as Special Prosecutor. President Nana Addo Dankwa Akufo-Addo before that had directed the Finance Minister, Ken Ofori-Atta, to resend the deal back to Parliament for deliberation.

Kroll and Associates

Another deal that raised major red flags and political fallout involved a firm named Kroll and Associates from the UK and the Government of Ghana.

The Auditor-General, Daniel Domelovo, accused the Ministry of Finance following the release of its annual report on Public Accounts of Ghana (PAG), of paying Kroll and Associates, a private UK-based advisory firm, US$1 million for no work done to warrant such payments.

The report said that there were various inconsistencies in some of the documentation and as to how the contract was awarded for the firm.

“Though the contract was signed in September 2017, some of the invoices attached to the payment vouchers predated the award of the contract,” the Auditors General report noted.

The Finance Ministry in 2017 acquired the services of Kroll Associates to recover assets from identified wrongdoers, probe allegations of wrongdoing, provide evidence for assets recoveries, build capacity for the transfer of skills, offer council on preventative techniques and structures to detect and forestall future corruption.

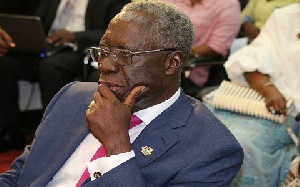

The Auditor-General then fingered the Senior Minister, Yaw Osafo-Maafo, as being part of the deal after he alleged his persistent failure to provide proof of actual work done by the firm.

Daniel Domelovo on his part then surcharged Osafo-Maafo and the four other officials from the Ministry of Finance. He also disallowed the payment of the US$1 million to Kroll and Associates, which the government, through the Ministry of Finance had authorized.

After a trade-off of words in public by the Senior Minister and Auditor General, the office of the President on June 29, 2020, directed the Daniel Domelovo to proceed on his accumulated leave for 123 days.

The directive was met with some public displeasure with some critics describing the move as dictatorial.

The President in a statement also directed the Auditor General to hand over all matters relating to his office to Mr Johnson Akuamoah Asiedu, the Deputy Auditor-General, to act as Auditor-General, “until his return from his well-deserved leave.”

The statement explained that the President's decision was based on sections 20 (1) and 31 of the Labour Act, 2003 (Act 651) which apply to all workers, including public office holders such as the Auditor-General.

Daniel Domelovo on his part said he was very much aware that his work was “embarrassing the government” hence the directive by the President.

In response to the President’s directive, the Auditor General said the move had, “serious implications for the constitutional independence of the office of the Auditor-General.”

Payboy Company Limited

Following the closure of defunct gold dealership firm in 2018, Menzgold Limited, emerged Payboy Company Limited, an alleged offshoot of the defunct gold trading company.

Payboy’s sudden emergence raised some red flags after the Economic and Organised Crime Office (EOCO) revealed that officials of the digital payment, marketing and promotions company had to be arrested due to their lack of requisite licence to operate from the Bank of Ghana or the Security and Exchanges Commission.

The company on its part was requesting customers to pay an amount of money in order to retrieve their locked-up funds from the defunct gold-trading company, Menzgold Company.

“Initial investigations have revealed that the company was operating without the requisite licenses from either the Bank of Ghana or the Security and Exchanges Commission,” EOCO explained.

Further investigations revealed Menzgold appointed Payboy as a third-party entity to negotiate the settlement with customers of the defunct gold dealership firm.

Business News of Wednesday, 30 December 2020

Source: www.ghanaweb.com

Controversial business deals of 2020 that raised suspicions

Entertainment