Governor of the Bank of Ghana, Dr Ernest Addison has said the global financial markets have eased somewhat reflecting decisive monetary, financial, and fiscal policy actions which have helped stabilize investor sentiments.

According to him, confidence indicators are beginning to show signs of improvement although still below pre-pandemic levels, especially in countries that have successfully slowed the pace of COVID-19 infections. Notwithstanding these signs of early bounce back, lingering concerns of a second wave of the pandemic seem to be weighing on risk sentiments, with implications for borrowing costs, currency stability, and rising debt levels.

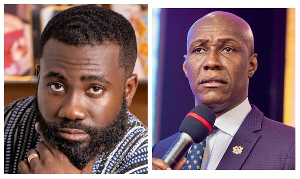

He was speaking during the sitting of the Monetary Policy Committee (MPC) on Monday July 27.

The outlook for the global economy remains uncertain despite these early encouraging signs of recovery. Signs of a second wave of infections and intensification of the pandemic in other economies is sparking fears of a re-imposition of restrictions and containment measures, leading to a further slowdown in the world economy.

Global inflationary pressures remain subdued reflecting low energy prices and sharp drop in real GDP with significant slackness in labour market conditions. Core inflation remains low in Advanced Economies and inflation projections have generally been revised downwards in the near term.

In Emerging Market and Developing Economies, the BoG said the inflation dynamics will continue to depend on the direction of movement of the exchange rate and the impact of COVID-19 on food prices.

On the domestic scene, there has been some pressure on headline inflation. After remaining flat at 7.8 percent in the first quarter, inflation jumped to 11.2 percent in the second quarter.

This sharp increase was driven in large part by food prices, which spiked in response to the panic-buying episode preceding the partial lockdown that was announced at the end of March 2020.

Food prices continued to increase from 8.4 percent at the end of the first quarter to 13.9 percent at the end of the second quarter. Non-Food inflation also rose from 7.4 percent to 9.2 percent, but this has been at a much slower pace than food prices.

The sharp rise in inflation in the second quarter has somehow disrupted the disinflation process.

Meanwhile the MPC has kept the policy rate at 14.5 per cent.

Business News of Tuesday, 28 July 2020

Source: laudbusiness.com