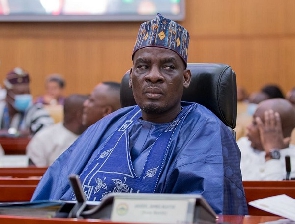

The minority in parliament has said they will resist every effort by government to increase VAT by 2.5 per cent adding that the increment will worsen the cost of living for Ghanaians.

According to Haruna Iddrisu, the president has no moral right to increase VAT after he led the demo in 1995 for the same tax increment that claimed five lives.

Speaking at a press conference, he said, "Whilst whittling away the little we have as a country in this intransigent manner, the Akufo-Addo/Bawumia government has decided to pile more hardships on the people of Ghana through the introduction of more taxes in the 2023 Budget presented to Parliament."

He added, "The most punitive among these taxes is the addition of 2.5% to the VAT rate bringing it to a cumulative 21.5% (made up of 2.5% GETFund, 2.5% National Health Insurance, 1% Covid Levy and 15% VAT all levied under the terms of Value Added Act, Act 870) the highest in Africa. What moral right does President Akufo-Addo have to increase VAT by 2.5% when he led the 'KUMI PREKO' demonstration in 1995 resulting in the loss of five lives. As sure as night follows day, this will worsen the hardship faced by Ghanaians, as the prices of almost all items will increase instantaneously once this tax comes into effect."

Haruna Iddrisu said the minority will no longer allow a government that is "determined to waste Ghana’s resources on extravagant living."

Government has announced an increment in Value Added Tax (VAT) by 2.5 percent for consumers of goods and services.

The move, according to government is expected to improve government's domestic revenue measures while seeking to reach an IMF deal to restore macroeconomic stability.

"Mr. Speaker, we will undertake the following actions, initiatives, and interventions under the seven-point agenda. To aggressively mobilize domestic revenue, we will among others: Increase the VAT rate by 2.5 percent to directly support our roads and digitalization agenda; Fast-track the implementation of the Unified Property Rate Platform programme in 2023; and Review the E-Levy Act and more specifically, reduce the headline rate from 1.5% to one percent (1%) of the transaction value as well as the removal of the daily threshold," he said.

The Minister of Finance, Ken Ofori-Atta, made this known in parliament when he delivered the 2023 budget before lawmakers on Thursday, November 24, 2022.

But the minority has vowed to oppose this VAT increment.

NYA/FNOQ

General News of Monday, 5 December 2022

Source: www.ghanaweb.com