The Volta River Authority (VRA) is to raise US$500million through selling corporate bonds to investors on the capital market to raise funds for financing its infrastructure projects.

The electricity producer hopes to raise the amount to finance four new projects that will generate 700 megawatts of electricity within three to four years.

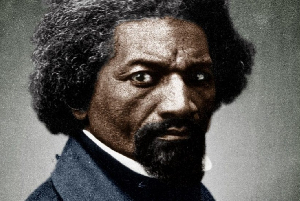

“We have identified three or four projects for which those funds will be raised. These projects add up to about 700MW. If we are successful in raising those funds this year, we will start constructing those projects later this year or early next year. Each project easily takes 3-4 yrs to construct,” Mr. Kweku Andoh Awotwi, Chief Executive Officer of the VRA, told B&FT in an interview.

The company hopes to: resolve all the current power-generation challenges facing the country; be profitable again; and adopt the International Financial Reporting Standard (IFRS) in anticipation of the bond issue during the last quarter of the year.

It is assiduously working around the clock to generate enough thermal power to augment the shortfall in hydro-power sources as a result of a 200 megawatt shortfall in production caused by damage to a section of the West Africa Gas Pipeline.

The situation has led to the suspension of operation at the 200 megawatt Asogli Power Plant-- which relies solely on gas from the West Africa gas pipeline to generate electricity.

Ghana’s own gas input into the generation of electricity is not expected until September, when the Gas Company will have laid the pipeline to carry gas onshore from the Jubilee oil field.

The West Africa Gas Pipeline Company has assured that supply of gas will resume in May; the VRA is on schedule to bring online power supply from its TAPCO and T3 plants; and the Bui Power Authority has assured of bringing on-stream 130megawatts.

Energy experts say the country requires US$200million of investment to bring on-stream each year 200 megawatts of new capacity. However, Government is not able to keep up with that kind of investment.

Annual electricity demand and consumption is rising between 8-10 percent. Electricity demand and consumption hit 1,664 MW in 2011, and grew to 1,800 MW in 2012. The Ghana Grid Company Limited (GRIDCo) estimates that the country needs 340 megawatts of reserve power capacity for contingencies.

VRA currently spends about US$2.5million per day to generate thermal power and requires US$50million to import 400,000 barrels of crude oil every 20 days. It is estimated that the VRA will by the end of March have spent about US$300million.

Currently, there are no definite regulations governing generation of electricity in the country; and lack of incentives has deterred the private sector from venturing into the sector.

“We need to come to a place where there are incentives to bring on new capacity --whether that is coming from the public sector or private sector. But that also means the regulations and the regulatory environment also has to provide those incentives. It’s not just the money - if the tariff is not right, investors won’t invest,” the VRA boss said.

General News of Friday, 22 March 2013

Source: Radio XYZ