A City trader "gambled away" £1.4bn ($2.3bn) of his firm's money and caused "chaos and disaster", a jury has heard.

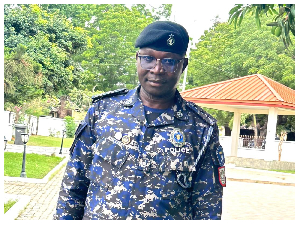

Kweku Adoboli, 32, of Whitechapel, east London, exceeded his trading limits at UBS in a bid to get a bigger bonus and boost his ego, the court was told.

He denies two charges each of false accounting and fraud between October 2008 and last September.

His actions saw the Swiss bank's share price fall 10%, around £2.8bn ($4.5bn), and also threatened their existence.

Opening its case, the prosecution said Kweku Adoboli exceeded his trading limits and invented fictitious deals to cover his tracks.

Sasha Wass QC said the trader "did all of this by exceeding his trading limits, by inventing fictitious deals to conceal this, and then he lied to his bosses".

She added: "This colossal loss arose purely as a result of Mr Adoboli's fraudulent deal making, which amounted, as you will see, to nothing more than gambling."

Ms Wass said that on 14 September, Mr Adoboli left his office saying he had a doctor's appointment. Later that day he emailed his employers admitting his deceit and he was arrested the next day.

Mr Adoboli had been working as a senior trader at UBS's global synthetic equities branch, buying and selling exchange traded funds, which track different types of stocks, bonds or commodities such as metals.

Ms Wass said Mr Adoboli had been "sucked into the gambler's mindset" and "started throwing good money after bad".

The prosecutor said the trading loss was enough to pay a year's salary for nearly 70,000 new nurses, or two Wembley stadiums or six new hospitals.

Ms Wass said Mr Adoboli had "fraudulently side-stepped" the bank's rules that banned high risk and unauthorised investments.

"Mr Adoboli had ceased to act as a professional investment banker and had begun to approach his work as a naked gambler. He had become what is sometimes referred to as a rogue trader," she said.

But the prosecutor said the defendant had gone beyond the behaviour of a "mere rogue trader", faking records over a two and a half year period.

She said: "He faked bookings, he created false accounts and conducted himself as a master fraudster, deliberately and systematically deceiving and defrauding the bank which was employing him."

It is claimed that Mr Adoboli made false entries to make it seem as if the money he was gambling had been balanced by money coming into the bank.

Prosecutors also claimed that he failed to hedge several of his investments, as he should have done, in order to make a bigger profit for the bank and a larger bonus for himself.

The trial continues.

General News of Friday, 14 September 2012

Source: BBC

UBS trader Kweku Adoboli 'gambled away' £1.4bn

Entertainment