....How Databank Stuck SSNIT

AFTER MONTHS OF forensic examination, a team of private sector auditors have uncovered a complex scam dressed up as a neat legitimate deal that ultimately fleeced the taxpayers and SSNIT contributors of an amount that tops ?16 billion in today's cedis.

The investigators have docked the top management of SSNIT, Messrs Charles Asare and Asiedu Gyamfi, former Director General and current Head of Investments respectively and also recommended the criminal prosecution of Messrs Enterprise Insurance, Databank and Awoonor Law consultancy.

Chronicle's own forensic re-examination of the report's highlights confirmed large sections of the report but raised questions over procedure and methodology in arriving at some conclusions in what is known as the 'Obotan, Garden of Eden in the City affair'.

Two key figures named in the scandal have already hit the roof claiming that they were never even interviewed before the auditors filed their report and are challenging what they see as unfair due process.

third has tendered his resignation but has had it turned down by his employers though he still insists on leaving.

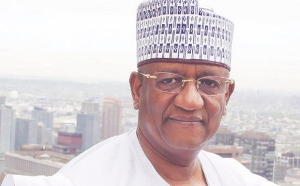

He is Asiedu Gyamfi who was named in the racket as he is the head of SSNIT investments as delegated to him by the Director General and the Board.

Mr. Asare himself has fired off a letter to the SSNIT Board complaining bitterly about the failure of the Forensic auditors to interview him on the matter while Mr. Ekow Awoonor has dispatched a letter to the President dated December 20th raising hell over the failure of the auditors to interview him.

He told this reporter that he only came in after the deal had been consummated and payments made.

Chronicle investigators confirmed that Mr. Ekow Awoonor and Charles Asare were never directly interviewed on the Obotan matter, but this reporter was told that alternate sources had been employed to solicit information from Awoonor who is even questioning the competencies of the auditors.

Only Mr. Ken Ofori-Atta and Kelly Gadzekpo of Databank/Enterprise Insurance are quiet. The whole deal revolves around Databank whose Chairman Mr.

Ofori-Atta was interviewed by the auditors.

Databank declined to be interviewed by the Chronicle.

Their lawyer and fellow traveler in a string of businesses Mr. Ekow Awoonor advised Keli Gadzekpo to respond to our written inquiries that also touched on the SSB bank sale affair in the presence of this reporter at Awoonor's Ridge offices.

Mr. Gadzekpo agreed to respond. Days later Databank wrote declining to answer with the explanation that inquiries are ongoing.

This reporter sought the publisher's (Kofi Coomson) assistance in unraveling the SSB sale matter that also involved Databank and SSNIT, and SSB .

Mr. Thompson the Managing Director of SSB Bank responded to questions on the affair posed by Mr.Kofi Coomson and requested for time to try and persuade Databank to respond.

More than two weeks days after the agreed deadline, nothing has been heard from Databank.

He said that he knew of the Obotan project but SSB never paid anything into it.

Databank presented themselves as financial advisers to Enterprise Insurance to SSNIT, HFC and SSB and promoted an investment package of a string of 29 bungalows for top notch Chief Executives to purchase along the independence avenue spread over a 3.5 acre plot.

In documentation circulated among the prospective investors, SSNIT then headed by Mr. Charles Asare was informed that the Garden of Eden project would have Enterprise Insurance Company(EIC), Home Finance Company (HFC) and SSB as partners.

Coincidentally, both EIC and Databank are described as promoters and documentation exists that present EIC as 42.5 percent shareholders with investments to the value of $1.7 million, SSB with 2.5 percent shares and SSNIT's shareholding as 55 percent.

Databank owns more than 54 percent of EIC through a company he runs called Ventures and Acquisitions Ltd.

They hold 2,606,909 million of the stock of EIC representing over 51 percent of the shares in EIC and between him and Keli, both Directors of EIC, they control EIC.

Smaller shares are owned by Databank clients that they run and control- like the Epack Investment Fund and other individuals with shares held in trust by Databank and of course controlled by them.

Evidence also exists that indicates that within 24 hours of Mr. Ken Ofori-Atta asking SSNIT to pay up, a cheque for $2 million was dispatched to him.

Mr. Ofori Atta's letter requisitioning the SSNIT boss to part with money was dated February 10, 1998.

The project has not even started, and the former Deputy Director General Mr. Eric Adjei had banged tables over the status of the 'ghost'project resulting in EIC offering to refund the $2 million.

Interviewed over the indecent haste with which the money was released - less than 24 hours after the request Mr. Charles Asare said that there had been prior discussion, and that the Board of SSNIT had okayed the transaction which had a projected 40 percent SSNIT stake.

The board was impressed with the projection and had even asked him to buy controlling stake in the project, culminating in a 55 percent stake.

The startling finding is that none of the prospective investors put in a pesewa. EIC, promoter cum shareholder did not put anything in. Neither did HFC nor SSB part with a dime.

Only SSNIT did with contributors'money. Mr. Charles Asare surprised at the revelations indicated that he did not know that EIC belongs to the same Databank boys, and that if he did he would have asked more questions.

'Mr. Asare, it would be hard to believe that you would be that na?ve or that incredibly foolish to fall for a sweet scam like that where the promoters and the financial advisers are one and the same and none of them parted with money but only you did'.

Mr. Asare told Kofi Coomson that EIC is a top listed public company that made it easy to deal with without extra due diligence.

He explained that he took their word for it without looking at the transaction which is stillborn, with a microscope

'Maybe I was fooled!' he told Kofi Coomson, deployed to assist with the Chronicle's own 'forensics' on the forensic.

At the HFC, their legal secretary insisted that they knew nothing about Obotan - Garden project.

Again this reporter sought the help of publisher who visited the offices last fortnight about the response of HFC.

Mrs. Stephanie Baeta Ansah in the company of the legal secretary and Mr.

Kwadwo Duku, Director and Financial head, admitted after complaints over HFC's non cooperative stance by its officials, apologized, and conceded that they knew about the Obotan project.

" Mr. Coomson, your name projects fear and apprehension and so we can only apologise for what my staff may have done".

The bottomline was that HFC did not part with money and offered to provide mortgage funding for the project.

She said that Mr. Ofori-Atta, promoter of the Obotan project who had been on the board of HFC had gone off the board.

Mr. Ofori Atta who had helped with HFC's search for foreign funding is also on the board of SSB, along with Mr. Ekow Awoonor.

The interesting aspect of the deal is that Databank still holds ownership of the disputed land and the three bungalows on them.

They paid $1.6 million for the property, told their 'investors' that it cost them $3.5. But the auditors report question the sale price as records show that land registry records indicate that there was an under-declaration.

An amount of c360 million is what the findings present , but Chronicle surveillance shows that the actual deal maker who played everything close to his chest, the former Managing Director of the French owned CFAO is now based in Mauritius, Mr Angland.

A watchman at the site who claims to have been hired by Databank was the only person present with another security man.

A breakdown of costs of the transaction by Mr. Awoonor post interesing expense accounts that boggles the forensic auditors:

Estate agency fee of $120,000.00, legal fees of $30,000, brokerage fees of $224,000, obviously infavour of Databank, and even electricity bills that have been forwarded to SSNIT to pay.

The role of EIC and its financial controller Mr. Sedoh in the transaction has been even more eye raising as he oscillated between truth and untruth over a period in his accounting to this reporter.