Ghana’s housing deficit, estimated at nearly two million units is set to receive a major boost following a new mortgage partnership between State Housing Company Limited (SHC) and Republic Bank.

The agreement aims to improve access to affordable home financing and ease long-standing affordability challenges within the housing sector.

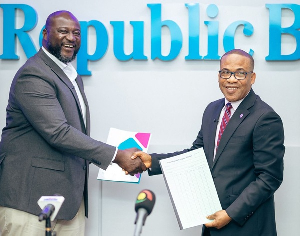

The memorandum of understanding (MoU), signed in Accra, is designed to expand mortgage availability to Ghanaians across various income levels, targeting one of the most significant constraints in the country’s real estate market.

Despite strong demand for housing, mortgage financing remains inaccessible to many, preventing a large section of the population from entering the formal housing market.

According to the World Bank, Ghana requires between 70,000 and 133,000 new housing units annually.

Cedi trades at GH¢11.42 to $1 on interbank market

However, current housing supply meets only about a third of this demand, with most developments concentrated in the high-end segment, far beyond the reach of middle- and lower-income households where the shortage is most acute.

Under the partnership, SHC will develop and supply housing units, while Republic Bank will provide tailored mortgage products aimed at increasing the number of Ghanaians who qualify for home financing.

The initiative is expected to enhance mortgage uptake and encourage greater investment in affordable housing.

Managing Director of State Housing Company Limited, John Bawah, described the collaboration as a significant step towards expanding homeownership.

He noted that the partnership is focused on enabling working Ghanaians who meet credit requirements to access mortgages when purchasing SHC properties, with customers of the company set to receive preferential consideration.

Republic Bank’s Managing Director, Dr Benjamin Dzoboku, said the agreement reinforces the bank’s commitment to deepening Ghana’s mortgage market.

He described the collaboration as a strategic alignment, with SHC driving housing supply and the bank supporting demand through accessible financing.

The partnership is expected to support government efforts to reduce the housing deficit, strengthen urban development, and improve social welfare by making homeownership more attainable for a wider segment of the population.

Also, watch below Amnesty International's 'Protect the Protest' documentary as the world marks International Human Rights Day 2025

Business News of Wednesday, 10 December 2025

Source: www.ghanaweb.com

SHC, Republic Bank forge mortgage partnership to address Ghana's housing deficit

Entertainment