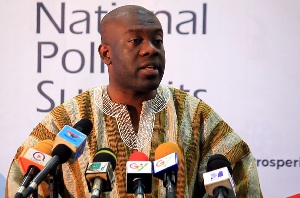

Information Minister-Designate, Kojo Oppong Nkrumah has dismissed suggestions that President Akufo-Addo is deliberately collapsing indigenous banks in the country.

According to Member of Parliament for Ofoase-Ayirebi constituency, the challenges that have bedevilled the banking sector started way before the NPP came into power.

Crisis In Fianacial Sector....Blame Gov't

The Minority in Parliament have never lost a moment to lay blame at the doorstep of the current administration for the collapse of some seven indigenious banks.

Late last year, UT Bank and Capital Bank were the first on the list of takeovers by the Bank of Ghana after it emerged the indigenous banks had fallen below the minimum capital requirement.

On August 1, 2018, almost a year to the unfortunate finanacial news, the BoG merged five local banks; Beige Bank, Construction Bank, Royal Bank, uniBank and Sovereign bank into what it calls the Consolidated Bank Ghana Limited.

Governor of the BoG, Dr Ernest Addison explained that the move was part of measures to streamline the financial sector.

Days after, the Minority in Parliament slammed government for not making the attempt to rescue the banks early enough.

Minority Spokesperson on Finance Casiel Ato Forson asserted it is unacceptable that within a period of eight months three locally owned banks had collapsed.

A Lot More Jobs Would've Been Lost If

Speaking in an intervivew with Kwami Sefa Kayi on Peace FM's morning show ‘Kokrokoo’, Monday, the Minister-designate stressed that government has saved jobs in the banking industry despite claims of jobs losses in the wake of the banking crisis.

According to him, even though some jobs have been lost in the crisis, a lot more people would have been out of work if the Central Bank had not intervened.

"It is not true government is deliberately collapsing the banking system; government is working hard in satisfying ghanaians and soon everything will be fine and just as President Akufo Addo has already indicated those responsible will be punished....It is true that some jobs have been lost but it is also true that a lot more jobs have been saved," he said.

Cedi depreciation

Touching on the cedi’s sustained depreciation to some major foreign currencies, notably the US dollar, Hon Kojo Oppong-Nkrumah asserted that though the local currency is trading at almost GHc5 to the dollar, the country is still seeing “a slower rate of depreciation.”

Currently, one dollar sells for GH¢4.95. In just two weeks, the local currency depreciated 3.03% against the US dollar.

But a 12 page report by the credit rating agency, S&P Global Ratings, published on 14th September, 2018, showed Ghana’s economic performance improved which resulted in Ghana being upgraded from B- to B.

It is stated in the report that “S&P Global Ratings raised its long-term foreign and local currency sovereign credit ratings on Ghana to ‘B’ from ‘B-‘”. The reputable credit rating agency added that Ghana’s “outlook is stable”.

The verdict by S&P Global ratings seems to have settled the debate on the economy in favor of the ruling NPP Government.

The Information Minister-designate was of the view that, with Ghana’s latest B rating published by Standards and Poor's (S&P) Global, “foreign investors will continue to have confidence in the economy and will help the cedi to appreciate."

He, however, cautioned against large withdrawals of cash to buy dollars and urged the general public, most especially business operators to "remain calm and believe in President Akufo-addo’s ability to fix the economy".

General News of Tuesday, 18 September 2018

Source: peacefmonline.com

S&P's B rating wiill help cedi appreciate – Kojo Oppong-Nkrumah

Entertainment