The government on Wednesday described the Quality Grain Project at Aveyime in the Volta region of Ghana as a scam designed to rip off the nation of millions of dollars.

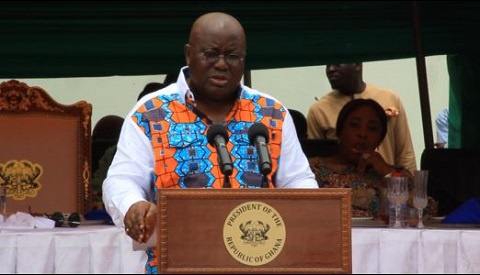

Briefing journalists in Accra, Nana Addo Dankwa Akufo-Addo, Attorney General, said his ministry in conjunction with the Ministry of Food and Agriculture (MOFA), is examining documents and evidence at the project site.

This is intended to establish whether there was any wrongdoing on the part of the various public officials who were associated with the project.

He mentioned former President Jerry Rawlings, former Vice-President Professor John Evans Atta Mills, former Minister of Finance, Mr Kwame Peprah, Chief Director of the Ministry of Agriculture, Mr Samuel Dapaah and former Minister of Food and Agriculture, Mr Ibrahim Adam.

He said several loans were granted on the orders or by the empowerment of senior officials of the Ministry of Finance or MOFA without parliamentary approval as indicated in Article 181 of the Constitution on how loans could be contracted by, for or on behalf of government.

He said the first external loan of 6,196,330 dollars was guaranteed by the previous government to finance supplies of farm materials in November 1996, followed by another 12 million dollars for purchase of capital equipment and related engineering services in July 1997.

"The third loan was guaranteed by government on July 22, 1997 for 1,274,305.25 dollars."

Nana Akufo-Addo said internal loans were also contracted. In February, the Minister of Finance authorized the Controller and Accountant-General to release two million dollars to the company.

He said 1.450 million dollars of this was to be transferred to the account of Quality Grain at the First Tennessee Bank, USA, to enable the company meet obligations for goods and services in the USA.

The remainder of the sum was to be released to the company to meet payment obligation for goods and services in Ghana.

Another loan of 150 million cedis under the Gateway Trade and Investment Programme was arranged by Dr George Yankey of the Ministry of Finance and paid by Ecobank.

"In October 2000, a loan of 259 million cedis was granted by Ecobank while another 346 million cedis was guaranteed by the Ministry of Finance in May as cost of fuel purchased by the company from Elf Oil Ghana Limited," Nana Akufo-Addo said.

Nana Akufo-Addo said the Ministry of Finance in May again guaranteed another loan of 34,500 dollars for fertilizer bought from Wienco Ghana Limited, adding that "there are other facilities centred at the Ghana Commercial Bank whose details are not yet at hand, but are being sought."

He said all the loans in favour of the company fall within the purview of the Constitution and that apart from the first external loan in November 1996 for 6,196,330 dollars, none of the other loans and guarantees extended to the company was approved by parliament.

"These loans, therefore, violate the constitution, violations which may carry legal consequences for the public officials who acted to effect them," Nana Akufo-Addo said.

He was, however, happy that government after all these anomalies could take over the company.

"Fortunately for the state, there is a direct legal way to cut some of the losses and attempt to gain some value from this entire sorry saga."

He said on November 13th, 1996, the company executed in favour of the ministry of finance a deed of indemnity and a floating change on its assets to provide security for the guarantees effected by the ministry.

He said the deed was to operate if the ministry was called upon to make good the default of the company.

"When that happened, the indemnity naturally was worthless. The Ministry has been paying on the default since September 1998 up to April 2001 approximately 20 million dollars without any hope of under indemnification. The only solution left is to enforce the floating change on the assets."

Nana Akufo-Addo said since 1998 when the deed was executed, no attempt has been made to register the charge, noting that it was yet another link in the chain of extraordinary negligence that has characterised management of this transaction by the "highest officials of the republic."

Nana Akufo-Addo said he has requested the application by Friday of an ex-parte for an order of the High Court to extend time for the registration of the charge.

"I am hopeful that the application would succeed. If so, we shall then make a formal application early next week for the formal take-over of the assets of the company including the farm and all its equipment."

He said government is not in favour of anything like state farms since the practice failed in the past.

The MOFA has been directed to submit to cabinet proposals for the full development of the enterprise once government has taken over.

Nana Akufo-Addo said Ms Renee Woodard, the African-American in the middle of the scam, first met President Rawlings at an investment drive in Atlanta, Georgia, USA, and was later introduced in Ghana to Mr Peprah as a rice production expert.

The Ministry of Finance was then asked to finance the project. He said Ms Woodard then incorporated a Ghanaian company of the same name as that of its Tennessee-based parent company - Quality Grain Company Ghana Limited - that owned all its shares.

Nana Akufo-Addo said the only document of the company's objective is a feasibility report on the production of rice under irrigation in Ghana by QGC.

"It did not contain a detailed plan and design, including full cost and the responsibilities of government under the financing arrangement proposed," he said.

"The feasibility report did not mention any problems with land acquisition or squatters... In fact this was not the case and the company had to spend two years getting squatters off the land before cultivation."

He said the report, "at the very least is misleading, if not fraudulent, made only to induce the granting of the loan facility."

General News of Thursday, 26 April 2001

Source: GNA

Quality Grain Accomplices Under Investigation