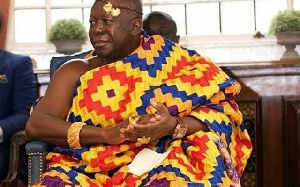

Management of Ghana International Bank has stated it has not cited the Asantehene Otumfuo Osei Tutu II in money laundering contrary to media reports.

The name of the Ashanti Monarch popped up last week at an Employment Tribunal over a cash transaction which resulted in the dismissal of a bank official.

The sacked official of the Ghana International Bank in the UK Mark Arthur was dismissed after the traditional ruler summoned him to his multimillion-pound residence in Henley-on-Thames and handed him a bag containing almost £200,000 in sterling as well as $200,000 in US currency for saving at the bank.

The aggrieved banker, from New Barnet, Hertfordshire, a dual citizen of the UK and Ghana, drove to his own home with the cash and then took it in an Uber taxi to the bank’s City offices for deposit in the king’s account, he told an employment tribunal.

In a statement to clarify the involvement of the Asantehene in the case, the bank said: “The Tribunal’s proceedings and its findings will be about whether the Bank was entitled to dismiss Mark Arthur as it did and not about the King, Otumfuo Nana Osei Tutu II.

“There has never been any suggestion by the Bank that the King was or is involved in money laundering. In fact, we have no evidence to that effect. The bank has also not in any of its submissions questioned the integrity of the King.”

Below is the full statement:

PRESS STATEMENT

Mark Arthur V. Ghana International Bank Public Liability Company Ghana International Bank Plc’s attention has been drawn to certain misrepresentations in the matter above and wishes to clarify its position as follows:

• Ghana International Bank Plc. operates in the United Kingdom and is subject to the regulations of the Prudential Regulatory Authority, the Financial Conduct Authority and the UK as a whole.

• These regulations guide the bank’s internal procedures, policies as well as the conduct of all of its employees.

• The Bank takes its legal and regulatory obligations very seriously as well as its duties and obligations to its customers. In this regard, staff are required under the bank’s whistle blowing policy and UK laws to report all suspicious transactions to the appropriate authorities. The consequences of the Bank not fulfilling its obligations can be far reaching at times. In some instances, staff seen to be liable could face a possible jail term and in extreme cases the Bank itself could face a withdrawal of its operating licence.

• The ongoing case which has caught public attention is about Mark Arthur’s breaches of the Bank’s internal policies and procedures as well as UK laws.

• The Tribunal’s proceedings and its findings will be about whether the Bank was entitled to dismiss Mark Arthur as it did and not about the King, Otumfuo Nana Osei Tutu II.

• There has never been any suggestion by the Bank that the King was or is involved in money laundering. In fact, we have no evidence to that effect. The bank has also not in any of its submissions questioned the integrity of the King.

• With a focus on the substance of the matter and for customer confidentiality purposes, the bank had applied for an anonymity order in September of this year ahead of the Tribunal Proceedings in October. This would have eliminated the mention of name of the king in the proceedings of the tribunal. Additionally, the Bank never mentioned the King nor identified him in any of the documents submitted to the Tribunal in its defence.

• Mark Arthur had however contested this and had won thus exposing the identity of the king and his name in the proceedings.

• The Bank has maintained a long standing relationship with the King and has worked closely with him on initiatives such as the Otumfuo Education Fund, in providing IT education to children in deprived communities. This is a project that the Bank is keen to continue supporting.

• “The bank also wishes to clarify that contrary to earlier media reportage, Mark Arthur had neither sought nor received authorization from the Chief Executive Officer of the Bank, Joe Mensah.”

THANK YOU

SIGNEDMYDDLETON COMMUNICATIONS LIMITED(ON BEHALF OF MANAGEMENT OF GHANA INTERNATIONAL BANK PLC)

General News of Monday, 16 October 2017

Source: starrfmonline.com

Otumfuo not involved in money laundering – Bank

Opinions