Ghana's currency has become a victim of the economy’s success following an oil boom, depreciating the most against the dollar this year in Africa after Malawi’s kwacha and eroding support for President John Atta Mills as he seeks re-election.

The cedi has weakened 14 percent to 1.9098 per dollar since the beginning of January, the fourth-biggest decline in the world, according to data compiled by Bloomberg. By the time Mills and his ruling National Democratic Congress party face voters in a Dec. 7 election, the cedi may be at a record low of 2 per dollar, according to Standard Bank Group Ltd. (SBK), Africa’s biggest lender.

Ghana’s debut as an oil producer in 2010 fueled the fastest economic expansion on the continent last year, spurring growth in imports of everything from machinery and oil to food, driving up demand for foreign currency and undermining the cedi. Consumers are now paying more for rice, cars, TVs and clothing as inflation soared to a 14-month high of 9.1 percent in April.

“The downside of a weak cedi is rising inflation,” Yvonne Mhango, a Pan-African economist at Renaissance Capital in Johannesburg, said in an e-mail. Growth in consumer prices may accelerate to 14 percent by the end of 2012, implying “there is an upside risk to interest rates, which is negative for credit growth and also raises the government’s debt-servicing costs.”

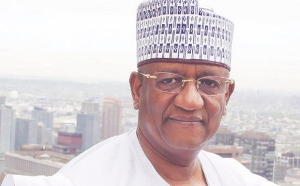

Ghana doesn’t have the manufacturing capacity to sustain the needs of an economy that expanded 14.4 percent in 2011 and is forecast by the government to grow 9.4 percent this year. Imports surged 20 percent in the first quarter to $4 billion compared with a year earlier, according to the Bank of Ghana. Mills’ re-election campaign, which focuses on his economic successes since coming to power in 2008, may be a victim of the cedi’s slump. The president will face New Patriotic Party leader, Nana Akufo-Addo, at the polls after defeating him by less than 1 percentage point four years ago.

“If this government doesn’t do something about the cedi soon it will be bad news for President Mills,” Kofi Manu Asamoah, 52, an importer of spare parts for Mercedes-Benz vehicles, said in an interview from his shop in Accra, the capital. “I am running at a loss because I spend more to buy dollars to pay for my imports,” Asamoah said, leaning against a shelf in his shop that was empty of customers.

With reserves at $4.4 billion, covering about three months of import requirements, the central bank is running out of ammunition to halt the cedi’s decline. Two interest rate increases this year have had limited success.

“The cedi’s situation is hurting us, we are on the losing side,” Kwasi Okoh, managing director of Aluworks Ltd. (ALW), an aluminum-products maker in the port city of Tema, said in an interview on May 8. “We purchase our raw materials in dollars so by the time we have sold our produce we have a shortfall in sales.” Costs have risen by 15 percent in the first quarter, he said.

Ghana’s economy depends on imports for “almost everything from rice to clothing to toothpicks” and rising costs may push up wage demands, Kwabena Nyarko Otoo, director of the labor research and policy institute of the Ghana Trade Unions Congress, said in an interview in Accra on May 17.

“If the cedi continues to fall then we could see some labor agitations for further increases in salaries to restore real income lost to price hikes,” he said.

The currency’s slump boosted costs at Guinness Ghana Breweries Ltd. (GGBL), a unit of London-based Diageo Plc (DGE) that makes the popular lager beer, Star, by as much as 12 percent in the first four months of the year compared with a year earlier, Anthony Attu, the company’s treasury manager, said in a phone interview from Accra on May 8.

“Our budget this year for the exchange rate was 1.6 per dollar and 2.5 per pound sterling, but these levels have already been broken,” he said.

The election itself is a source of cedi weakness as investors bet the government will struggle to keep spending in check, threatening a repeat of 2008 when pre-vote expenses boosted the budget deficit to 14.5 percent of gross domestic product. The shortfall is expected to reach 4.4 percent of GDP in 2012, according to the government.

“There is a lot of concern among investors and international community as to whether the government will be able to keep within the budget deficit target this year,” James Clinton Francis, a sub-Saharan Africa researcher at Eurasia Group, said in a phone interview from Washington. “The stakes are very high for both parties in the December elections and that gives them the incentive to spend.”

Philomena Annan, a grocer in Bubiashie, a suburb of Accra, is desperate for some relief as costs of staple foods, such as rice, climb.

“We are really suffering now,” Annan, 45, said in an interview on May 8. “I can’t even add profit margins to already high prices. President Mills must do something about the cedi.”

General News of Friday, 8 June 2012

Source: Bloomberg

Oil Boom Is Vote Curse For Mills As Cedi Slumps

Entertainment