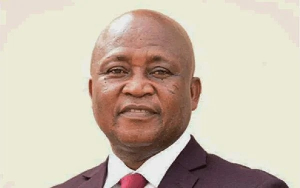

Chief Executive of MenzGold Ghana Limited, Nana Appiah Mensah, has issued a fresh application in court seeking a review of his bail conditions, which he has failed to meet last week.

He wants the court to reduce the conditions of the 1 billion-cedi bail.

A source close to the embattled man, popularly referred to as NAM1, confirmed their lawyers will appear in court on Tuesday, August 6 to move the application for variation of bail and argue for same to be considered by the court.

The source, however, declined to give details on the application, noting those will come up in court.

What are the conditions of the GHC1bn bail?

NAM1 was on July 26 granted 1 billion-cedi bail with five sureties by the Circuit Court after he pleaded not guilty to 13 counts of defrauding by false pretence, abetment, money laundering, unlawful deposit-taking, sale of minerals without licence and operating a deposit-taking business without licence.

Three of the sureties are required to be justified. Also, he is also to report to the police every Wednesday at 10:00 am

He has since failed to fulfill the bail conditions, which some have described as the biggest ever bail to be given in recent times in the country’s judicial history.

Charged with Nana Appiah Mensah are MenzGold Ghana Limited, Brew Marketing Consult limited, Rose Tetteh and Benedicta Appiah. Ms. Tetteh and Ms. Appiah are currently on the run.

NAM1 was arrested on July 11when he arrived at the Kotoka International Airport from Dubai where he was arrested and tried on misdemeanour charges by an Emirati court. He was however acquitted.

Prosecution’s case

In October 2018, about 16,001 customers of the defunct gold dealership firm lodged a police complainant claiming MenzGold and Brew Marketing made a representation and invitation through its officers Nana Appiah, Rita and Benedicta to them and the public to deposit money for fixed period with interest under pretext of purchasing gold from Brew marketing company.

Prosecutors say the gold purchased from the Brew Marketing was to be traded in by Menzgold to accrue monthly interest of 10 percent.

Based on the said representation, the prosecution said the complainants deposited a total amount of 1.6 billion cedis being their investments.

According to prosecution, its subsequent investigations into the complaints revealed Nana Appiah Mensah, Rita and Benedicta had absconded and their offices and residence locked.

A bench warrant issued for their arrest, he said.

According to the prosecution, investigations revealed that Menzgold and Brew Marketing were incorporated under the Companies Act, 1963 (Act 179) as limited liability Companies in December 2013 and December 2016.

It said the principal activities of Nana Appiah included gold and diamond mining, dealers in gold and other precious minerals.

Subsequently, in August 2016, he obtained licence from the state through the Minerals Commission to purchase and export gold from any person holding a small scale mining licence (small-scale miners).

However, per the terms and condition of the licence, Nana Appiah was required to appoint a gold buying agent to purchase gold on its behalf from small-scale miners. NAM1 thus set up Brew Marketing in December 2016.

Investigations showed that Brew Marketing though incorporated to purchase and sell gold among others, was not licensed by the Minerals Commission to trade in gold.

Meanwhile, Menzgold through Brew Marketing, after incorporation, went publicly to invite the public to deposit money with it.

The prosecution said the complainants accepted the invitation and deposited money.

Although the invitation was to purchase gold, the prosecution said Brew Marketing was not licenced to purchase gold, and that they merely acted as a nominee of an agent for Menzgold in the purported gold sales.

General News of Friday, 2 August 2019

Source: 3news.com