The Member of Parliament (MP) for Swedru constituency, Kennedy Osei Nyarko has slammed the Minority in Parliament for making unfounded allegation against the Finance Minister, Ken Ofori-Atta. He also chastised the Minority for intensifying their propaganda in opposition barely a year after losing the 2016 general elections.

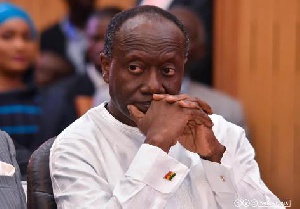

The Minority in Parliament has alleged that, Finance Minister, Ken Ofori-Atta sold the ninety five percent of Ghana’s recent 2.25 billion dollar bond to friends and cronies.

They have therefore called for a full scale investigation into the case since they believe it smells.

The Minority Spokesperson on Finance, Cassiel Ato Forson, claimed at a press conference on Tuesday that a non-executive director on the board of investment firm, Franklin Templeton that purchased majority of the bonds is also the Chairman of the Enterprise Group; a company closely aligned to the private interests of the Finance Minister, Ken Ofori-Atta. But the MP on the Majority’s side speaking to Kwame Tutu on Rainbow Radio 87.5Fm said, the allegations are untrue and has called on the public to treat it with contempt.

He said, the Minority members are bitter because the NPP has been able to do due diligence in issuing the bonds unlike the previous government who exhibited incompetence in the discharge of their duties.

He added, the company in question does not belong to the Minister is not doing business with Ghana for the first time and has done similar transactions with the NDC. Government on Monday April 3, 2017, announced it was successful in the auction of a total of 2.25 billion dollars in four bonds.

The first two bonds, totaling 1.13 billion dollars, was issued at 15 and 7 years period with the same coupon of 19.75%. In addition, the Ministry of Finance raised the cedi equivalent of USD1.12 billion in 5 and 10 year bonds via a tap-in arrangement.

General News of Friday, 21 April 2017

Source: rainbowradioonline.com