Business News of Friday, 8 September 2017

Source: todaygh.com

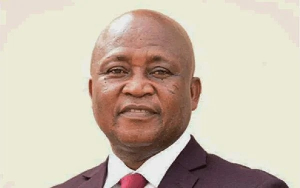

Government to insure state properties - NIC Boss

New Boss of the National Insurance Commission (NIC), Justice Yaw Ofori, has hinted of his determination to prevail on the government to insure state properties, explaining that insurance for public assets would represent a win-win situation for the country and the insurance companies.

According to him, given that the government was the largest spender, agreeing to insure all government assets could increase insurance penetration considerably.

He explained that insuring government assets will further provide financial pillow for the government and the country in times of disasters.

Unlike the western countries, where all state properties are forcibly insured, public properties in Ghana are not insured, something the new NIC boss said was not in the best interest of the nation.

Speaking on his vision for the NIC, he noted that he would want NIC to become a leading regulator in insurance on the African continent.

This, he said, required that the new insurance bill which was currently before Parliament was passed into law.

According to him, his strategy directions for the insurance industry over the next four years would be directed by his conviction that insurance was a national growth facilitator.

To Mr. Osei, if properly connected, insurance, which pivots on saving some money towards a difficult times, could become a key player in the growth of the financial services sector.

Given that most insurance policies, especially those in the life category, take longer terms to mature, Mr. Ofori noted that it was advisable that premiums collected on them were invested in long-term instruments to help guarantee better returns.

He mentioned the bond market as one of the places that he would be looking to encourage insurance companies to invest their premiums.

Given that bonds are long-term investment instruments, he said, insurers and the insured would be better off if the premiums were invested there.

He assured Ghanaians to expect a new and strong insurance commission.

“We should also expect insurance to be a key player in the financial sector. Insurance is to lead in the mobilisation of long-term funds for investment and that means that life insurance should be developed to a higher level.

In a similar manner the industry also expects government’s support to develop the bond market to serve as an avenue for insurance as well as the capital market.

“Also, I want to position insurance as a household name in Ghana. By that, I mean we have to improve the claims payment system; we have to revive confidence in insurance and things like that.”

According to Mr. Ofori, he also expects to improve on insurance penetration by making in-roads into the informal sector such as micro and agricultural insurance.

“All these, if well achieved, will increase insurance penetration in Ghana and further aid in the adoption of a risk-based supervision,” he stressed.

Entertainment