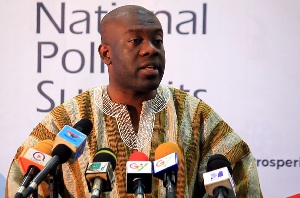

Information Minister, Kojo Oppong Nkrumah has said no firm decision has been taken on government’s proposed $50 billion centenary bond.

This follows huge criticisms against the move by a section of the populace including the minority who say it defeats the Akufo-Addo-led government’s Ghana Beyond Aid mantra.

Speaking during his state visit to the People’s Republic of China, President Nana Akufo-Addo said: “The Ministry of Finance and the economists in Ghana are looking at floating a $50 billion Century Bond”.

“This will provide us with the resources to finance our infrastructural and industrial development. We are hoping that, at some stage, China will interest itself, and take a part of it as China’s contribution to Ghana’s development”, the president said.

According to him, the centenary bond will be one of government’s means of securing long-term financial sources that “will allow us to deal with our infrastructural development, and also realise the vision of a Ghana Beyond Aid.”

The Minority who have kicked against the move have argued that the country cannot absorb such a huge facility.

Mr Gideon Amissah, a financial analyst and economist in an interview with Accra 100.5FM’s Katakyie Obeng Mensah on the Mid-Day news, Monday, 3 September 2018 said the move will result in a huge debt that generations unborn will have to come and pay, coupled with the already existing debt portfolio of Ghana.

In a sharp rebuttal however, Mr Oppong Nkrumah said no firm decision has been taken on the centenary bond.

Speaking to Class News, he said: “At this stage we are at the consideration stage, we are raising a number of questions to do some analysis. Example, is a centenary bond a good idea? If it is how much can our economy afford? What will be the repayment schedule for example? What are the implications on debt sustainability? We have to go through a series of processes to arrive at a position and then that position will be announced.

“The president has just signed eight MoUs and supervised two other contracts, those are the big things we can speak concrete to today. If he additionally mentioned that we are looking at the possibility of this in the future and if it happens we encouraged the Chinese to come on board, I don’t think we can reduce that to a full conversion now and say that government has decided to issue a 50-year bond and therefore what does the minority think of it? No.

“I feel that we have to report accurately what has happened so that all of us in terms of our analysis can do our analysis fully. So at this stage, we are considering a centenary bond, that centenary bond could come in a particular ticket size. The consideration at this stage is to examine all the things that is associated with it, how have other countries done it? What is the ticket size? What is the implication on debt sustainability? Could there be a possible moratorium? Etc, but those are not the big issues of today, those are just things government is thinking about.”

Business News of Monday, 3 September 2018

Source: classfmonline.com

Government hasn’t taken firm decision on $50bn centenary bond – Oppong Nkrumah

Entertainment