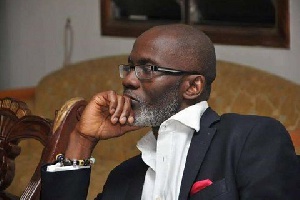

A leading figure of the New patriotic Party(NPP), Gabby Asare otchere-Darko says government has taken a cue from the public concerns over the possible tax increase.

There are fears government may increase taxes in its mid-year budget review, despite assurances of shifting focus of Economic Management on taxation to production while in opposition.

Reports say government is likely to increase the Value Added TaX (VAT) from 17.5% to 21% and National Health Insurance Levy(NHIL) in its mid-year budget set to be presented to Parliament on Thursday, July 19, 2018.

The recent reports on the tax increase by the NPP government have been met with stiff public opposition.

Amidst the growing reaction over the possible tax increment, minority caucus in parliament held its version of the Mid-year Budget Review code-named the mid-year Economic performance and projections; the minority’s perspective which comes ahead of the government’s mid-year budget review to be presented to parliament by the Finance Minister this week.

In a post on Facebook Monday, Gabby Asare Otchere Darko questioned the seeming anxiety over the Value Added Tax(VAT) saying he wonders why it has been greeted by so much public interest.

Nonetheless, he said the President and his Cabinet have already triggered a conversation over the massive public outcry in relation to the tax increase.

“I understand Ghana is hot over a question I raised whether the Government should consider raising VAT as an option to meeting essential spending targets? I find it extremely healthy and constructive even if it has led to hasty conclusions. What I gather from the debate is pretty clear. The Ghanaian people are not convinced that the taxes they pay are USUALLY used efficiently for their benefit. So to even consider asking them to pay more (as was usually, consistently the case under the NDC), they want to know about four basic things:

(1) What are you doing about cutting down wasteful expenditure?

(2) What have you done differently since 2017 with the taxes YOU (the Akufo-Addo government) collected?

(3) Can you look at other options of raising revenue without touching VAT? (4) The leakages are too much and deep. Can you do more to collect from those who are evading taxes?

The good news is that, if what we hear took place in Cabinet last Thursday is anything to go by, the President and his Cabinet are pretty much with them on all three. If there are bullets to be bitten, let those who pull the trigger be seen to be biting more. But, is VAT such a sacred cow and if so since when? Exciting times ahead.”

General News of Monday, 16 July 2018

Source: kasapafmonline.com