The Center for Policy Analysis (CEPA) has expressed worry at the rising debt stock of the country.

After falling sharply on account of the Highly-Indebted Poor Country (HIPC) initiative and the Multi-lateral Debt Relief Initiative (MDRI) involving external debt cancellation, forgiveness and relief, Ghana's public debt stock increased from $9.2 billion in 2009 to $10.3 billion at the end of June this year.

This represents about 65 percent of Gross Domestic Product (GDP).

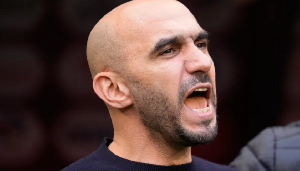

Joe Abbey, Executive Director of CEPA, who spoke to the media yesterday in Accra ahead of the launch of the Economy of Ghana 2010 Mid-Term Report which is scheduled for today, cautioned Government about the extent of borrowing, saying it could trigger higher interest payments, arrears and spell doom for other economic gains.

"It is not good to have a very high debt rate. It is so shocking for people to celebrate victory for acquiring loans without considering the implications.

What do we say about the debt service implications on our economy," Dr. Abbey noted, referring to the recent agreement sealed between the Ghana government and the Chinese government over a $13 billion loan deal. "When your debt situation is high, you ruin the country by printing more currency to service the debt, hence causing devaluation of the currency, it promotes corruption, he added.

A couple of weeks ago, the International Monetary Fund (IMF) warned that Ghana's economy could collapse in the next two years if the fiscal state and the extent of borrowing by Government was not checked.

CEPA also admits that the current macroeconomic stabilization programme was leading to high unemployment rate especially among young graduates.

It noted that Ghana's fiscal deficit target would not be achieved as its outlook predicted a large budget deficit in 2010, missing the target by a wide margin than in 2009.

Government, about a month ago, revised the budget deficit target of 6 percent of GDP to 8 percent.

According to the policy think-tank, its analysis is in line with the Monetary Policy Committee of the Bank of Ghana report released on September 24, 2010 which stated that the economy was operating below its potential.

The sluggish pace in economic activity in 2010 indicates that the fiscal consolidation might be delayed as tax revenue targets are unlikely to be achieved, the report stated.

On some of its outlook for the rest of the year, CEPA pointed out that the projected sterling performance by the Internal Revenue Service (IRS) would not be enough to compensate for shortfalls in collection by the Customs Excise and Preventive Service (CEPS) and the Value Added Tax (VAT) Service as well as non-tax revenues.

CEPA also noted that the sluggish pace in economic activity in recent times would affect the non-oil sectors of the country, especially manufacturing, which is at a risk of collapsing.

General News of Thursday, 21 October 2010

Source: Daily Guide

Ghana's Debt Situation Alarming

Entertainment