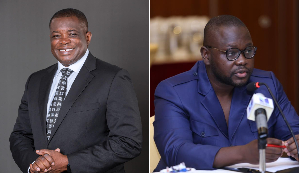

The Bank of Ghana Governor, Dr Johnson Asiama, has said that deposit-taking banks in the country remain sound, profitable, and well-capitalised.

Deposit-taking banks, which are financial institutions licensed to accept deposits from the public and provide credit, play a crucial role in supporting economic activity.

Speaking at the 127th Monetary Policy Committee (MPC) press conference on November 26, 2025, Dr Asiama noted that financial soundness indicators in the sector show relative improvement on a year-on-year basis.

“Deposit money banks remain sound, profitable and well-capitalised. The financial soundness indicators, including solvency, profitability, asset quality, and efficiency indicators all point to relative improvement in year-on-year terms,” he stated.

BoG reverts to 14-day bill as main tool for Open Market Operations

He also revealed that the Non-Performing Loan (NPL) ratio declined to 19.5 percent in October 2025, from 22.7 percent in October 2024, driven by a pickup in bank credit and a contraction in the stock of NPLs.

“The Non-Performing Loan (NPL) ratio declined to 19.5 percent in October 2025, from 22.7 percent in October 2024, driven by pickup in bank credit and contraction in the stock of NPLs. However, credit risks remain elevated,” he added.

Dr Asiama further explained that policy actions to recapitalise a few undercapitalised banks, along with the full implementation of new regulatory guidelines aimed at reducing NPLs, would strengthen the banking industry.

Meanwhile, the Bank of Ghana (BoG) on November 26, 2025, lowered its monetary policy rate by 350 basis points, bringing it down from 21.5 percent to 18 percent, following the conclusion of its 127th Monetary Policy Committee (MPC) meeting.

According to BoG Governor Dr Johnson Asiama, the decision was reached after a majority vote by members of the MPC.

The policy rate guides the interest rates at which banks lend to businesses and households, making it a key tool for managing inflation, stimulating investment, and supporting overall economic activity.

MA

Business News of Wednesday, 26 November 2025

Source: www.ghanaweb.com