Business News of Tuesday, 9 June 2020

Source: www.ghanaweb.com

Defunct fund managers: GH¢2 billion worth of claims not credible - SEC reveals

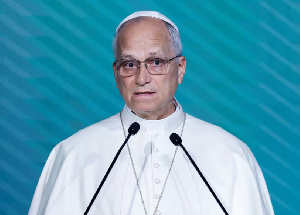

Director General of the Securities and Exchange Commission (SEC) has revealed that GH¢2 billion worth of claims filed by customers of defunct fund management companies were not credible.

According to Rev. Daniel Ogbarmey Tetteh, the liquidation process for defunct management companies has also started with two liquidation orders filed so far before payment can be made to customers.

“So far, the validation of claims has shown that claims worth about GH¢2 billion aren't credible. The original value of GH¢12.5 billion has now shrunk to GH¢10 billion and that is because of the validation process. This shows how important validation is” Daniel Ogbarmey Tetteh said on the Citi Breakfast Show on Tuesday 9 June 2020.

He added; “The liquidation process has started although because of the processes involved, we can't state exactly when it will end. But hopefully, we don't have to wait for liquidation to end before payment starts”

Rev. Obamey Tetteh indicated the position of government is to get a full sense of the validated amount before the payment of the claims to customers can commence.

The Director General also revealed officers working on the validation of claims have completed around 50 percent per their last report to the SEC.

Customers of collapsed fund management companies, were in March 2020 assured by the SEC of their locked funds, after a successful validation of their claims.

This follows the revocation of licenses of some 53 fund management companies last year for various regulatory breaches.

Members of the Coalition of Aggrieved Customers of the defunct 53 Fund Management Companies, called on government to commence payment of their locked-up funds before March 24, 2020.

The group earlier said they believed government has deliberately been silent on the payment of their funds following the financial sector clean-up by the Bank of Ghana (BoG)

Entertainment