The Chamber of Petroleum Consumers has proposed the capping of taxes on petroleum revenue with the hope that it will force the state to widen the tax net rather than over-rely on proceeds from the petroleum sector.

The Chamber is of the view that if the current situation is maintained, the baselines for Ghanaians will go up, cost of living will go up and with their revenue, income staying the same.

Speaking to Regina Borley Bortey campaign trail on Starr FM, Executive Director of the chamber Duncan Amoah called for a more strategic implementation in the increase of world oil prices as the current system increases the baseline consumption of the ordinary Ghanaian.

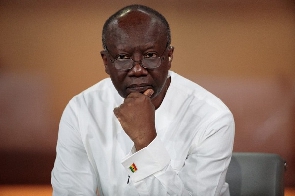

He said, “if you leave it as it is where every finance minister as the prerogative to change as much taxes as they want, depending on whatever revenue projections they want and developmental projects they want to embark on, you might get a fiance minister later called Duncan Amoah who says that ‘go and slap 1000 percent taxes on petroleum’ and nobody can say anything.”

“So, it has come to a point where you need to cap the amount of taxes you can generate from petroleum alone. Once you do that you will now be forcing these finance ministers to expand the economy, and widen the tax net. Instead of concentrating all their energies on collecting taxes on petroleum alone.”

He went on “I also say this on the back of the fact that anytime you increase fuel prices, they are increasing the baselines, cost of living for Ghanaians.”

Touching on the recent increment of fuel prices translating into the hike in transportation fares, he noted “once you doing that, the market woman moving from her house to work and paying more for transport would invariably charge you more for the tomatoes that she's selling. So, the food basket and food prices will go up. Cost of services and goods would go up.”

“Once you allow fuel prices to move the way it does on the international market, the only thing you are doing is increasing the baseline for Ghanaians without increasing as much their revenues or incomes, that is something we need to look at properly,” he added.

Business News of Friday, 17 July 2020

Source: starrfm.com.gh