President John Dramani Mahama has given presidential assent to the COVID-19 Health Recovery Levy Repeal Act, 2025, officially making it law.

The President’s assent formally abolishes the 1% charge on goods, services, and imports that was imposed at the height of the COVID-19 pandemic by the Akufo-Addo-Bawumia government.

Government to scrap COVID levy in 2026 budget statement

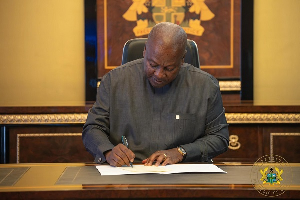

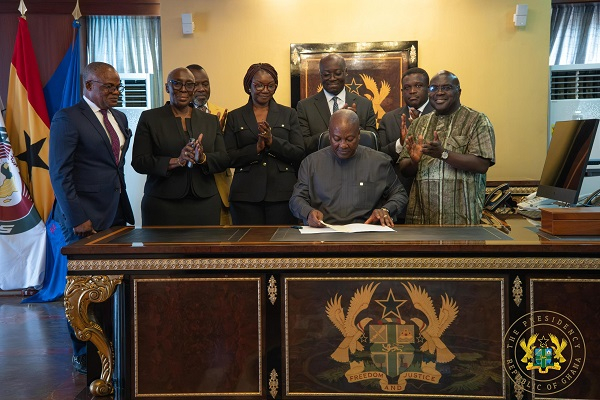

Signing the Act at the Jubilee House on December 10, 2025, President Mahama expressed his excitement at fulfilling promises his government made to Ghanaians during the 2024 election campaign.

“This is the COVID Health Recovery Levy Repeal Act 2025 and it's my honor and privilege to sign to repeal the COVID levy. Promise made, promise delivered and today is the 10th of December 2025.

“Purported to provide free water, free electricity, free food, and a lot of things and to the shock of most Ghanaians after the pandemic was over and after the elections were over, government slapped Ghanaians with a 1 % value added tax, or sensibly to recover what it's supposed to have spent on the uh COVID pandemic,” he said.

The president added, “Ghana continues to remain one of the only countries where we're being taxed for a pandemic that had passed. During the election, we promised that when the NDC comes to power, the COVID levy is one of those [taxes] we will repeal. A lot of Ghanaians have disliked this tax and today I'm pleased that on the 10th of December, 2025, I've signed the repeal act to remove the 1 % COVID levy.”

The repeal of the COVID-19 Health Recovery Levy follows parliamentary approval in November 2025.

Speaking in Parliament during the presentation of the 2026 Budget Statement and Economic Policy on Thursday, November 13, 2025, the Minister of Finance, Dr Cassiel Ato Forson, noted that the decision forms part of the government’s broader plan to ease the tax burden on citizens and businesses while promoting growth and economic recovery.

The COVID-19 levy, introduced in 2021, imposed a 1% charge on goods and services to help fund healthcare infrastructure and pandemic-related expenditures.

Parliament passes Value Added Tax Bill (2025), COVID-19 levy abolished

The tax has since faced public criticism for increasing the cost of living amid existing economic pressures.

MAG/MA

Also, watch below Amnesty International's 'Protect the Protest' documentary as the world marks International Human Rights Day 2025

Business News of Wednesday, 10 December 2025

Source: www.ghanaweb.com