The Bank of Ghana (BoG) is the apex bank in Ghana, and, therefore, presumes to have all the expertise when it comes to modern banking practices, but the decision to ignore a legitimate court order, resulting in a GH¢14,000,000 judgement debt hanging on the neck of the government, remains a conundrum begging for solution.

Apart from this puzzle, the bank also stands accused of substituting the judgement of a competent court of jurisdiction without the knowledge of the judge who sat on the case, and used that as the basis to revise the terms and conditions set out in the original judgement.

Pieces of information gleaned from official documents indicate that on December 1, 1997, ASTEK FRUIT PROCESSING LTD., headed by Dr. Albert Ababio Owusu, sued the BoG claiming the sum of $1,702 736, which represents proceeds from two shipments of fruit juice which the plaintiff sent to a Libyan company, Agrimark, in 1996, through the Horticulturist Association of Ghana. Per the agreement, the BoG was supposed to pay for the cost of the fruit juice, but refused to do so, despite repeated demands.

The Chronicle independently gathered that proceeds from the sale of the fruit juice were used by the Libyan authorities to offset the cost of crude oil imported from Libya by the government of Ghana, hence the onus on the BoG to settle the exporters in Ghana. The court, presided over by Justice Nana Gyamera, heard that ASTEK had earlier shipped 40 containers of the fruit juice to Libya, and been paid by the BoG.

The last two containers under dispute were shipped on February 4, 1996 and March 11, 1996 respectively. According to the plaintiff, after the shipments, he received a letter from the Ghana Embassy in Libya, dated March 18th, 1996, to cease further shipment of the fruit juice. Then, on May 27, 1996, he received another letter from the BoG, where it indicated that they would not pay for the two shipments.

BoG’s evidence in court

The BoG’s reason was that the Ghana-Libyan permanent joint committee meeting held in Libya in November 1995, decided that no further shipment of goods should be made from Ghana, with effect from November 22, 1995. However, goods in transit or awaiting shipment from the date of the cut off period (22-11-95) should be accepted by Libya.

The apex bank contended in court that it was not under any obligation to pay for the two shipments, because documents covering them were received long after the cut off period. The plaintiff, however, denied the claim by the BoG that the cut off period was 1995.

In his ruling Justice Gyamera noted that the first puzzle that must be resolved was whether the cut off period was indeed 1995. The court noted that though all the witnesses who testified on behalf of the BoG insisted that the cut off period was 1995, minutes of the meeting held in Libya, where the November 22, 1995 cut off period was set, which was authenticated by the witnesses, did not have any date on it.

Justice Nana Gyamera quoted the minutes of the said meeting as follows: “A proposal was made to link the principal debt US$32.5m owed by the government of Ghana to the Libyan government, and $21 million owed by Agrimark to HAG (Horticultural Association of Ghana) over imports made by the former from the latter.

The Libyan side stated that from the stipulation of the banking arrangement between the Bank of Ghana and Central Bank of Libya signed between the central banks of both countries on April 6th, 1989 in Tripoli, the debts owed by each country to the other, whether government or commercial debts, were qualified as official debts, and would be settled through a special account, as per Article 1 of the said banking arrangement.

“After discussions, it was decided that the outstanding debt be the subject of special negotiations between the government of Ghana and the Libyan economic delegation, which will visit Ghana on the matter in December 1995. In this regard, commercial transactions as from 21st November 1995 will not form part of the current debt.”

Argument by the court

Justice Gyamera argued that “nowhere was it stated in the minutes that there should no longer be export of goods from Ghana to Libya by the HAG. All what was said was that those commercial transactions (i.e. goods exported by HAG to Agrimark) shall not form part of the current debt i.e. will not be linked to government debt,” the judge noted.

The Presiding Judge also noted that the BoG admitted in court that they always paid the exporter in the local currency even before their accounts in Libya were credited with exports made by HAG to Agrimark. Justice Gyamera argued that the decision taken at the Tripoli meeting in November 1995, did not, in his view, affect this arrangement.

The court also noted with concern a letter written by the BoG to the Minister of Foreign Affairs, dated August 11, 1997, in which it stated: “We should note that the Libyan importers have themselves notified our mission that no further export should be consigned to them after 4th March, 1996. ASTEK/HAG, however, made their shipments to Libya on 4th February, 1996 and 11th March 1996.”

The judge, again, made reference to a letter written by the Ghana Mission in Libya to the President of the HAG, where the mission stated in part: “Agrimark has notified mission that it has decided to suspend the importation of goods mentioned in the HAG/AGRIMARK trade agreement. Agrimark further indicated it has cancelled 27th July, 1995 trade arrangement signed between it and HAG, with effect from 14th, March, 1996. Any goods sent after this date will, therefore, not be accepted.”

“With the above, I am inclined to accept the evidence of PWI (PLAINTIFF) that the cutoff date was rather 14th March, 1996, but not 22nd November, 1995.

Accordingly, if the goods in question were shipped on 4th February, 1996, and 11th, March, 1996, the goods could not be said to have been shipped after the cut off period,” Justice Gyamera noted in his ruling.

The court further wondered why Agrimark will write to the Ghana Mission in Tripoli stating that the cutoff date was 14th March, 1996, if the same Agrimark had taken part in a meeting with officials from Ghana, where a cutoff date was set at 22 November, 1995, as claimed by the defendants (BoG) “It is due to the above reasons that I have come to the irresistible conclusion that the case of the plaintiff has been sufficiently made out. I, accordingly, enter judgement in favour of the plaintiff in the sum of US$1,702,736 to be paid in the local currency at the Forex Bureau rate of exchange.

“I have already indicated the defendant’s refusal to transmit the document to Libya had no legal basis. I, therefore, order the defendant bank to pay interest on the amount with effect from 22nd June, 1996 at the then prevailing bank rate, or at the present bank rate, whichever is higher. I award the plaintiff 10% costs on the amount,” the judge ruled. Despite the clear directive from the court that the judgement debt, plus interest, be paid in cedis, the BOG refused to do so, and purported to have entered into agreement with the lawyer for the plaintiff to pay the money in dollars.

Subsequently, in a letter dated February 9, 1999, sent to counsel for the plaintiff by the then deputy Governor, E. Osei Kumah, indicated the BoG’s preparedness to pay principal of $1,702,736, and the interest of $241,164.17.

Though Mr. Owusu, who is the Managing Director of ASTEK, admitted that he had been paid the principal money, he denied, in an interview with The Chronicle, that the interest which must be paid in cedis had paid to him. He regretted that despite the repeated demands on the bank, including a letter he sent to the current Vice President, who was then the Governor of the BoG, Mr. Amissah-Arthur, has fallen on deaf ears.

According to Dr. Owusu, a calculation done by O.A. K, a charted accounting firm, indicates that the interest has now ballooned to GH¢14,558, 922, which is over 140 billion old cedis. BoG denies responsibility The BoG, in a letter dated September 15th, 2011, signed by Elly Ohene Adu, head of Banking Department, sent to ASTEK Fruits Processing Limited, is, however, arguing that they had complied with the court judgement. Elly Ohene Adu writes: “Your letter dated 8th August, 2011 on the above subject matter refers. We write to confirm that from the judgement debt of the court, dated 11th November, 1998:

(a) The sum of US$1,702,736 due you was to be paid in the local currency at the forex bureau exchange rate

(b) The Bank of Ghana was to pay interest on the amount stated in (a) above with effect from June 22, 1996 at the prevailing bank rate, or at the present bank rate, whichever is higher and

(c) The Bank of Ghana was to pay you 10% of the amount stated in (a) as costs.

“Subsequent to the judgement, we note you came to agreement with the bank as to how judgement would be enforced.

“In this regard, we note that the former Deputy Governor, Mr. E. Osei Kumah, wrote a letter to your lawyers, dated February 9th, 1999. This letter made reference to discussions relating to the enforcement of the judgement of 11th November, 1998.

This is clear indication that ASTEK and Bank of Ghana agreed that payment be made as per content of the said letter, i.e. that the principal and the interest be paid in US dollars, and the cost in cedis. Consequently, payment was settled by the bank. “From the foregoing, it is our view that the judgement debt in your favour was revised by the two parties, and that you subsequently received payment to that effect in 1999.

“You waived your right to enforce the original terms of judgement by agreeing to amend the payment terms and receiving payments to that effect. You cannot, therefore, lay claim twelve years later to any further benefits from the judgement, as you have already enjoyed the fruits of the judgement in full.”

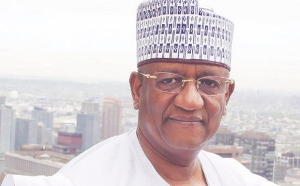

Amissah-Arthur

Upon the receipt of this letter, ASTEK wrote back to Mr. Amissah-Arthur, drawing his attention to the fact that they had not instructed the BoG to negotiate any terms of payment with their lawyers, and that the purported agreement over the settlement of the judgement debt did not receive his consent.

The ASTEK letter also noted that if the purported agreement was meant to be a substitute for the judgement, it should have been filed in court for the judge to accept, but this did not happen. ASTEK is, therefore, threatening to drag the government to court to enforce the full payment of the judgement debt. In this case, the government will have to cough up a staggering GH¢14 million at the time most statutory payments are in arrears.

General News of Tuesday, 8 July 2014

Source: The Chronicle

BoG hits gov’t with ¢140bn debt

Entertainment