Business News of Thursday, 29 January 2026

Source: thebftonline.com

BoG cuts gold exposure by 50% on concentration concerns

The Bank of Ghana (BoG) has reduced the share of gold in its reserves by 51 percent and reinvested the proceeds into foreign-currency assets – betting on yield and liquidity even as bullion prices hit record highs, Governor Dr. Johnson Asiama has stated.

The central bank said this move is a deliberate rebalancing rather than a retreat from gold, arguing that reserve accumulation has continued to rise despite the reduction in bullion holdings to about 18.6 tonnes from the 38.04 percent recorded at the end of October 2025.

The decision comes at a time when global gold prices have surged above historic levels, driven by a mix of geopolitical risks, central bank buying and financial market uncertainty.

As of January 28, 2026, the spot price of gold reached a record high of US$5,289.38 per ounce.

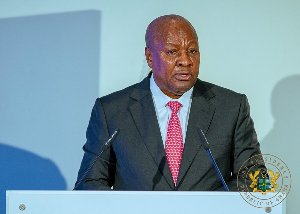

Dr Asiama said the central bank had previously held more than 40 percent of its reserves in gold, prompting a review of concentration risks and returns.

“At the time, we were holding a little over 40 percent so the decision was made to diversify, and that is what you see,” he said during the 128th Monetary Policy Committee press briefing in Accra.

“The effects that were aimed at are there. It is earning dividends and contributing to reserve accumulation,” he added.

As part of the strategy, the Bank sold gold for foreign exchange and invested the proceeds – adding to its stock of income-generating reserve assets.

Governor Asiama stated that reserves have continued to build, describing the change as a portfolio adjustment rather than a weakening of external buffers.

Gross international reserves rose to US$13.8billion at end-December 2025, equivalent to 5.7 months of import cover – up from US$9.1billion, or 4.1 months, a year earlier.

The Governor cautioned against reading too much into the current rally in gold prices, noting that not all of the drivers are permanent.

“It is true gold prices have risen to record levels, way above US$5,200,” he said, referring to global benchmarks.

“You have to understand that there are several factors that drive gold prices. Some of these factors are transitory, some are structural. What you see now may be more transitory and may not be permanent,” he further stated.

He said future decisions on gold holdings will be guided by structural considerations and an assessment of what level is optimal for Ghana’s reserves.

The central bank plans to continue rebuilding reserves this year while reviewing the appropriate balance between gold and other assets.

Gold has played a key role in Ghana’s improved external position. The country recorded a provisional current account surplus of US$9.1billion in 2025 – a major jump from US$1.5 billion the previous year, supported by strong gold export earnings, higher private transfers and lower services and income payments.

Gold dominated the export profile in 2025, accounting for 67 percent of total shipments.

Export receipts from the metal, estimated at US$20.97billion, were sufficient to outweigh the US$17.5billion spent on imports of all goods combined.

Those inflows, combined with capital inflows, produced a balance of payments surplus of US$3.98billion- helping to stabilise the cedi.

The currency appreciated by 40.7 percent against the US dollar in 2025 after a 19.2 percent depreciation in 2024, a development the central bank has often described as a correction from the excessive depreciation of the preceding years.

The development was brought about by reserve accumulation, tight monetary policy and favourable global conditions, the Bank said. The cedi has remained relatively stable in the first weeks of 2026.

Policy rate

The gold rebalancing comes alongside an easing of monetary policy as inflation has fallen faster than expected.

The MPC cut its benchmark policy rate by 250 basis points to 15.5 percent at the January meeting, extending an easing cycle that saw cumulative cuts of about 1,000 basis points in 2025.

This comes as the effective Ghana Reference Rate (GRR) for January 2026 is 15.68 percent.

Inflation slowed sharply to 5.4 percent in December 2025 from 23.8 percent a year earlier, below the central bank’s medium-term target band of 6 percent to 10 percent.

Despite the rate cuts, Dr Asiama said the Bank maintained control over liquidity through sterilisation to preserve the inflation anchor.

Reserve money growth slowed to 12.5 percent in 2025 from 47.8 percent the previous year, while broad money growth eased to 16.5 percent from 31.9 percent.

The Governor also addressed concerns about the costs associated with gold-related operations and broader balance sheet pressures at the central bank, particularly following losses linked to the domestic debt exchange.

He said those costs should be viewed in the context of the Bank’s mandate to ensure price and financial stability.

“We are not a profit-making institution. In carrying out our mandate, yes, you will incur costs. But those costs have to be put into the proper perspective. These are legitimate costs that we incur for the public good,” Dr Asiama insisted.

He added that government has committed to recapitalising the Bank of Ghana under recent amendments to the central bank law, to help strengthen its balance sheet over time.

Looking ahead, the Bank said it will continue to monitor gold market developments, global financial conditions and domestic economic trends as it calibrates both reserve management and monetary policy.

The cut in holdings comes as the Ghana Gold Board, known as GoldBod, prepares to take full operational control of the domestic gold trade in 2026.

The agency reported more than US$10billion in revenue from artisanal and small-scale mining (ASM) in 2025, though the BoG’s trading framework has raised some eyebrows over its financial efficiency.

In its 2025 assessment, the International Monetary Fund flagged about US$214million of what it called quasi-fiscal losses linked to trading margins and operating fees under the gold programmes.

The Fund advised that such costs be transferred to the national budget rather than retained on the central bank’s balance sheet.

During a December 2025 review, the IMF reiterated that the gold-for-reserves programme is intended primarily as a buffer – stressing the need for greater accounting transparency to prevent erosion of the central bank’s capital position.

Governor Asiama recently told parliament that the gold-for-oil programme remains suspended pending an external audit, following reported losses of GH¢2.43billion.

Policy in 2026, he noted, will instead centre on streamlining the gold-for-reserves initiative – with GoldBod operating as a separate entity to shield the central bank from risks in physical commodity trading.

BoG lowers policy rate from 18% to 15.5%

Banking sector shows resilience as assets, profits grow in 2025 - BoG

Banking sector shows resilience as assets, profits grow in 2025 - BoG

Entertainment