AngloGold has all but declared victory in its bid to merge with Ashanti Goldfields after sweetening its offer and securing a written commitment from the Ghanaian gold miner's largest shareholder.

Ashanti's board resolved unanimously to recommend AngloGold's revised merger proposal at a meeting in Accra on Tuesday after AngloGold increased its all-share offer from 26 of its own shares for every 100 of Ashanti's to 29 to a 100.

The revised proposal is worth $1.43bn, up from $1.3bn and the offer, valid until end-October, would create one of the world's largest gold-mining companies.

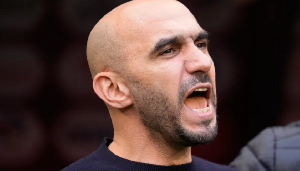

On completion of the merger existing Ashanti shareholders would own about 14.5 per cent of the enlarged company's issued share capital . Randgold Resources last month entered a rival all-share bid for Ashanti worth $1.5bn. Earlier this week Mark Bristow, Randgold's chief executive, signalled his readiness for a bidding war with AngloGold when he told the Financial Times he would consider raising his company's bid should AngloGold increase its own.

But Bobby Godsell, AngloGold's CEO, said he had secured "an irrevocable commitment to support our offer" from Lonmin, which owns 27.6 per cent of Ashanti's issued share capital. AngloGold said Lonmin had undertaken not to enter any discussions with Randgold unless that company produces a "fully underwritten cash proposal" which the board of Ashanti determines to be superior.

"Both offers have been around awhile," Mr Godsell said. "We think this is the time to make a final decision, and this is our final offer."

On Wednesday, Mr Bristow said that the value of the improved final offer from AngloGold was still below Randgold's original offer as well as Ashanti's closing price in New York on Tuesday. "We shall be taking all these factors into account in considering our positions and we'll be making a formal announcement in this regard at an early opportunity," he said.

Randgold, which has secured a revolving credit line worth $250m from five banks to back its bid, would likely struggle to come up with an all-cash merger offer.

Any deal is subject to regulatory approval and the endorsement of Ashanti's shareholders including the government of Ghana, which owns about 17 per cent of Ashanti, including a "golden share" giving it veto power over major business decisions.

Since Randgold entered the running for Ashanti, AngloGold has sought to belittle the offer by pointing to its own larger balance sheet and allegedly superior technical expertise, both needed to develop mining down to 2,500 metres at Ashanti's Obuasi deeps.

But Randgold has mounted an energetic counter bid, appealing to Ghanaian national pride by pledging to keep Ashanti's name and existing head office in Accra. Mr Bristow has travelled to North America, the UK, Europe and Ghana in recent weeks to sell his bid to Ashanti's shareholders and public opinion.