Opinions of Thursday, 23 March 2023

Columnist: Abraham Ofori

How a remittance fraud syndicate was busted in 5 minutes of ‘friendly’ customer interactions

It was a fine Monday morning, just before midday, the banking hall had been busy all day with customers visiting in numbers as expected for Mondays; the previous Friday was very hectic for us all.

A customer came threatening us for stealing his MTCN (Money Transfer Control Number), I was the chief "suspect", the customer said, complaining bitterly in the presence of the Branch Manager that the MTO(Money Transfer Organisation) had confirmed that indeed the money had been withdrawn; he was not wrong at all, my checks at the first time of search indicated the control number was unavailable.

It was a great source of worry for not only myself but all of us at the branch, and this was for two reasons; firstly the fact that customers lost money through no fault of ours or theirs and then the reputational risk inherent in these types of occurrences. In fact, over a space of two months close to 5, regular customers of ours openly promised not to do business with us again and indeed they were not seen any longer; what made matters worse was getting to the root cause eluded us all.

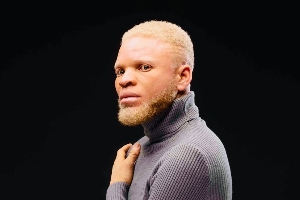

One Saturday, a loyal client of ours who had been a victim of remittance fraud came to transact but told me she only came because the bank across the highway had a long queue of which she could not wait, she then pointed to a dark, slim, rasta-haired guy who just entered our banking hall saying "this guy was also at the bank before I left there". She further advised us to be cautious of the gentleman because he could have ulterior motives.

This was an allegation and moreover, the guy had been a regular face at our premises for months, so I doubted her allegation initially, but later it occurred to me that he has never had a successful transaction before. All his transactions either had wrong recipient names or could not be found; we would just ask him to re-check with the sender and off he goes, we never suspected him.

I knew I had a potential lead but without any evidence, I had no grounds to tie him to the thefts so I decided over the weekend to be on the lookout for him subsequently when he visits next time.

Weeks passed by, then on that fateful day this gentleman came into the banking hall as he usually does on busy days when we had lots of customers. My heart skipped a beat initially when I saw him, this, I believe prepared my senses for what was ahead.

I observed him closely as he picked a form at the writing area, stood close to another person and began writing, then in a shocked move he began stealing glances at the other customer's form as he wrote, it confirmed my fears but then I could not raise an alarm because I had no evidence to tie him to any crime.

The victim was the first to complete his form, I quickly prevented him from joining the queue and under the guise of helping him skip the queue I entered his code only to be told "transaction is being processed by another terminal", at the second entry a "transaction not found response" was received indicating clearly the customer's money had been withdrawn, my heart skipped a beat again but then I had to keep myself calm.

I still did not have the evidence to prove that the rasta-haired suspect was involved in sending the MTCN to a different agent, I ordered the victim to have a seat and quickly took screenshots of the initial and subsequent responses I received, my next task was to locate the victim's control number on the suspect's phone.

I knew I had to be extremely nice and friendly to gain the trust of the suspect. He usually will not be in a hurry to be served, regardless of the queue length he will wait to be served.

This time I hurriedly called him nicely and courteously to skip the queue for me to serve him, the first time keying his code. I realized the transaction bore a different recipient name, a usual feature of his transactions; I told him the number was wrong and needed to see it on his phone to verify its accuracy. This was my first attempt in searching for the victim's control number, all the victim had no idea his money had been withdrawn.

The suspect showed me a chat from an unnamed contact on WhatsApp showing several control numbers, I scrolled upward in search of the victim's number but to no avail. The suspect re-scrolled the chat back to where he showed me as I held the phone.

This was an apparent move to prevent me from going through his messages with the contact. It was a difficult moment as I had less time and seemed to have run out of ideas as to how to locate the victim's number on the phone. Any move that was not properly thought through could result in a botched move as the suspect will get to know my intention and the victim would blame me for the loss of his money.

In a last-ditch move that ultimately proved successful, I asked him for his phone again telling him I missed a digit in his code and needed it to confirm the accuracy of his number. He obliged and in a split second of thought I intentionally dropped his phone and in bending over to pick it up I searched for a different chat on his WhatsApp platform named "Irene Bnk".

There I saw the victim's code boldly sent to this contact; the two sent marks colored blue to indicate the message had been read by the contact. There I knew my quest was complete. I had my evidence tying him to the crime, I gathered my evidence and phoned my immediate supervisor telling her of the incident, but out of the blue, the suspect started moving out of the banking hall.

I had no option but to yell at the security men to arrest him when he eventually started running.

He confessed after his arrest that the codes were usually sent to agents in different banks outside of Accra. The monies will be split when they are successful. We wasted no time in whisking him to the nearby police station, he refunded the victim's money later and we never encountered this problem thereafter.

Remittance fraud features prominently in Bank of Ghana's fraud reports yearly. Readers must safeguard their control numbers from the view of others even if they are not in the banking hall, fraudsters are dynamic and will go any distance to get hold of your funds even before you get to an agent to withdraw.