Opinions of Wednesday, 7 February 2024

Columnist: Dr. Alexander Nti Kani

Criticisms surrounding importation of pollutants, reflecting misplaced priorities and environmental hypocrisy

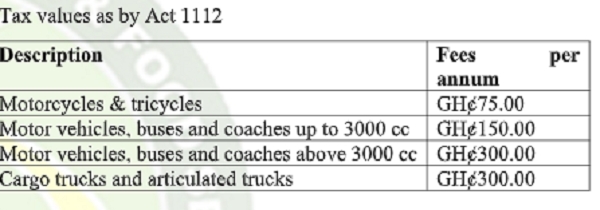

The recent implementation of Ghana's Emission Tax through the Emissions Levy Act of 2023 (Act 1112) has stirred controversy, leading to concerns about the government's environmental priorities. As an organization, we find it necessary to engage in the ongoing discourse and advocate for the reconsideration of this tax. We argue that the current approach exhibits environmental inconsistency by taxing emissions while allowing the importation of pollutants.

In the United Kingdom, where emissions from cars are taxed, the process is transparent and equitable. The tax rate is determined based on a vehicle's CO2 emissions at the time of registration. Unfortunately, Ghana's implementation of a similar law lacks clarity, leading to questions about the criteria used to establish emission values. We question whether the flat rate imposed reflects a well-considered strategy to reduce the country's carbon footprint or simply

serves as a revenue-generating mechanism for the government.

Additionally, we seek clarification on whether other modes of transport, such as sea and air, are subject to emission taxes and how these taxes are utilized.

Taxing vehicle usage without considering the carbon footprint is a misguided strategy, especially given Ghana's participation in global initiatives aimed at reducing carbon emissions. Despite receiving significant payments ($4,862,280) for carbon reduction efforts through Emission Reductions Payment Agreements (ERPAs) with the World Bank's Forest Carbon Partnership Facility (FCPF), there's a lack of transparency regarding fund utilization. This raises concerns about the government's apparent neglect of prioritizing net emissions reduction over imposing taxes on vehicles.

Moreover, Ghana's lenient stance on fuel quality, allowing diesel imports with over 3000 parts per million (ppm) of sulphur, contrasts sharply with global transitions to Ultra-low-sulphur diesel (ULSD) with substantially lower sulphur content. While countries like Kenya, Mauritius, Morocco, and South Africa shifted to 50 ppm diesel in 2010, Ghana's reluctance poses environmental and health risks.

Permitting the importation of high-sulphur content fuels, known for contributing to acid rain, health hazards, and engine damage, contradicts the government's focus on taxing emissions from ‘imported goods.’ This apparent hypocrisy highlights the greater threat posed by the importation of polluted fuels. In light of these facts, Ghana's carbon emission strategy appears misguided. Rather than imposing taxes on imports, the government could align its policies with global fuel quality standards and maximize revenue potential from existing carbon reduction initiatives.

Recommendations include prioritizing the adoption of clean and low-sulphur fuel with less than 30 ppm, aligning with sustainable development goals, and offering several compelling advantages. Investing in cleaner fuels directly addresses environmental concerns, particularly air quality, contributing to reduced emissions of sulphur dioxide, a major air pollutant detrimental to respiratory health and the environment. This prioritization of cleaner fuels can effectively

mitigate the negative impacts of air pollution on public health.

Moreover, embracing cleaner fuels aligns with global efforts to combat climate change by significantly reducing the carbon footprint. This not only demonstrates environmental responsibility on the global stage but also supports international climate change mitigation efforts.

From an economic perspective, investing in cleaner fuels has the potential to stimulate the growth of a cleaner energy sector. This encouragement of investment in sustainable technologies fosters job creation within sustainable industries. This contrasts with the potential burdensome impact of taxing emissions on businesses and consumers.

Additionally, prioritizing clean fuels aligns with the global trend towards sustainable practices, making Ghana potentially more attractive to international investments and partnerships. This enhances the nation's reputation as a responsible and environmentally conscious entity, opening avenues for collaboration with other countries and organizations committed to sustainable

development.