Diasporia News of Monday, 3 December 2007

Source: .baltimoresun.

Maryland high court hears foreclosure case

House was taken, resold in '05, despite Columbia man's mortgage payments

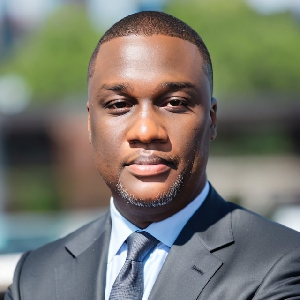

ANNAPOLIS, Md. (AP) ? The Maryland Court of Appeals heard oral arguments today in the case of Kwaku Atta Poku, the Columbia cab owner who lost his family's townhouse to foreclosure after a refinancing, despite having made every mortgage payment.Based on the questions they asked lawyers, several judges on the state's highest court appeared disturbed by Atta Poku's loss, but other judges seemed unsure how to provide a remedy without overturning a legal foreclosure.

Attorneys for the immigrant from Ghana fought to overturn rulings in favor of Washington Mutual Inc., the national mortgage company that took and resold his Howard County house in 2005. Maryland law does not require a mortgage company to prove that a homeowner has been notified of a foreclosure and allows the taking of a house in a few weeks

After the hearing in Annapolis ended today, Atta Poku said he was disappointed that the discussion mostly dealt with technical details about property foreclosures. "If the law keeps all these technicalities, then justice will be stampeded," he said.

Scott C. Borison, Atta Poku's lawyer, told the court, "The suggestion is there is some kind of road map out there" for how to remedy a foreclosure alleged to be unjust, but that there isn't one.

After the hearing, Borison said Atta Poku faced a "Kafkaesque" situation in which a foreclosure can happen more quickly than anyone can move to stop it, leaving homeowners at a disadvantage.

Kenneth MacFayden, a lawyer for Washington Mutual, told the judges the sale was legal and that to reverse it would raise questions about the title of foreclosed properties. "How will I ever be able to transfer a title again?" he asked.

No one from Washington Mutual has blamed Atta Poku for the foreclosure. Shane Winn, a spokesman for the company, said his firm never received payment for the first mortgage, and Atta Poku was unable to prove it was paid off when he refinanced, partly because crucial financial documents were lost by the financial institutions involved in the transaction.

In written filings, Atta Poku's lawyers cited the settlement sheet for the refinancing to argue that the foreclosure was illegal because the mortgage was paid in full. They wrote that Atta Poku took no cash out of the refinancing and that his sole purpose was to reduce his interest rate and pay off the original mortgage.

Atta Poku's lawyers asked the Maryland Court of Appeals to hear the case after the Court of Special Appeals dismissed his appeal because he couldn't afford to file a bond.

It is not known when the high court will issue a ruling in the case.