Diasporia News of Wednesday, 24 April 2013

Source: Citi FM

GT Bank launches account for non-resident Ghanaians

Guaranty Trust Bank, in a bid to extend its services to Ghanaians in the diaspora, has introduced a new product called the Non-Resident Ghanaian (NRG) Account.

This innovative product offers Ghanaians and their families living abroad the opportunity to open and operate a local bank account from anywhere in the world for savings, remittances, business and other purposes such as building a house, educational support, future security or establishing a seed capital to start up a business venture in Ghana.

Amounts saved could be used as collateral for a loan facility as well.

The NRG Account provides customers access to a wide range of banking products and services, some of which include Current and Savings Accounts, Foreign Exchange Account, Foreign Currency Account, investment in Money Market instruments, eBanking services and card products such as MasterCard and Visa.

With access to the Bank’s internet banking platform, instant notification system, a Relationship Manager and other e-banking-based services, account holders abroad can conveniently operate the GTBank Non-Resident Ghanaian Account from their base around the world with ease.

It can be operated in Cedi, Dollar, Euro and Pounds and statements of accounts are sent via emails and SMS.

Deposits are done through conversion of foreign currency to Cedi account via transfer from a bank account abroad. Cash and cheques can also be deposited into accounts by relations or other people instructed to do so on behalf of the customer at any of the Bank’s branches in Ghana.

Withdrawals can be made through the use of Visa and MasterCard cards, cheques and transfers via Internet Banking platform to GT Bank customers and customers of other Ghanaian banks. Account holders who sign email indemnity forms can also instruct the Bank via email to make payments to named beneficiaries.

The NRG Account is safe and provides peace of mind to customers who are skeptical that monies sent to family and friends for projects would be squandered as access is restricted to account holders only.

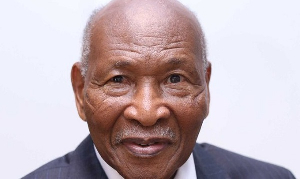

The Managing Director of Guaranty Trust Bank (Ghana) Limited, Mr. Lekan Sanusi during the introduction of the product stated that, “Coming out with the NRG Account is in line with our new strategic focus to continue to bring our services even closer to all Ghanaians irrespective of their location worldwide”.

“The NRG Account is an excellent characteristic of a business solution with reliability, convenience and safety in mind and we believe it will go a long way to further deepen our unrivaled customer delivery”, he added.

Guaranty Trust Bank (Ghana) Limited, Bank of the Year for two consecutive times in 2009 and 2010 was registered in October 2004 and obtained its universal banking license from Bank of Ghana on 23 February, 2006, thereby paving way for the commencement of operations.

It has also been awarded for Product Innovation, Customer Care, Advisory Services, Competitive Pricing, Loan Financing etc.

It presently operates from 23 outlets spread across six regions in the country, namely Greater Accra, Ashanti, Western, Brong Ahafo, Volta and the Northern regions. Preparations on expanding its services to the Central and Eastern regions are far advanced.

It is presently listed on the Ghana Investment Promotion Centre’s Club 100 and has since its inception seven years ago grown to become a reference point for good business practice and a role model in financial service industry in the country.