Business News of Thursday, 13 November 1997

Source: --

Mills Launches VAT Education Programme

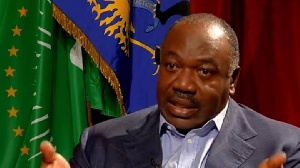

Accra, (Greater Accra) 11 Nov. Vice-President John Evans Atta Mills today asked Ghanaians to be dispassionate in their approach to the Value Added Tax (VAT). ''We should not politicise it. VAT is not being introduced to win political points for the NDC. It is being introduced to build a better Ghana,'' he said. Professor Mills was launching the VAT Public Education Campaign and the unveiling of the VAT logo in Accra today. The campaign, put together by the Ministry of Communications and a consortium of five public relations and advertising companies aims at introducing VAT as ''a more friendly, efficient, effective, fair and modern tax system''. The logo has the 'V' written in red with an upward stroke on one side as in the tick for 'correct'. The 'A' and 'T'are written in black and all the three letters are embossed in a yellow background indicating a ''fresh start''. A white line encircles the yellow background. Underneath it all is written: ''It's Correct.'' Prof. Mills asked Ghanaians to accept VAT adding that the traditional tax collecting agencies, Internal Revenue Service (IRS) and the Customs, Excise, and Preventive Services (CEPS) are now incapable of generating more taxes. ''Both the IRS and CEPS have reached a plateau as far as finding more avenues for collecting taxes. Other countries which found themselves in similar situations have taken to VAT and have benefited,'' he said. Mr. Kwame Peprah, Minister of Finance and Chairman of the VAT Oversight Committee, said more resources need to be mobilized to propel Ghana into a middle-income earning economy by the year 2020. He said VAT is one of the means of collecting more taxes without increasing the burden of the tax payer adding that the campaign aims at getting all spectrum of society to understand VAT to make its implementation more acceptable. Mr. Ekwow Spio-Garbrah, Minister of Communications and Chairman of the VAT Public Education Committee, said inadequate publicity and lack of public awareness which caused the failure of the introduction of the system two years ago, will be avoided. He said the campaign with such features as Papa VAT, Maame VAT, and the VAT children, aims at making VAT more acceptable to the public than when it was first introduced two years ago. The audience was shown some of the VAT publicity campaigns on television, radio and in the print media.