Business News of Thursday, 9 February 2017

Source: 3news.com

Telcos raise red flag over BoG’s mobile money intermediary

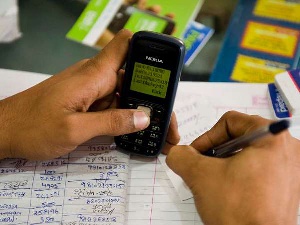

Telecom operators in the country have raised red flag over moves by the central bank to impose on them a third-party company as intermediary in mobile money transactions across different networks.

The opposition by telecom operators follows an award of a 4.6 billion cedi contract to Sibton Switch systems to enhance interoperability in mobile money transactions across telecommunication networks.

Although managers of the firm have justified the 4.6 billion cost for the project, it has emerged Sibson’s price tag was the most expensive among the companies that bid for the project.

Two bids in the contract amounted to GHc 14 million, GHc 5.4 million from Vals Intel Limited and Mericom Solutions Limited.

According to Sibton Switch Systems, the BoG, which regulates the mobile money operations of the telcos, will however not be funding any part of the tender as it is planning to build, operate and own the system.

Before telcos could fully roll-out a form of interoperability, the BoG announced that it had secured the services of a private switch that will handle the interoperability.

Analysts have explained that mobile money transfers will become expensive since the high cost of the project will be passed on to users.