Business News of Wednesday, 13 August 2014

Source: starrfmonline.com

Ghana Cedi fallen by 23%, not 40% – Gov't

The Government of Ghana has rebuffed local and international media reports that the currency of the world’s second-largest gold producer has fallen by 40 percent since January this year.

While the local media drummed on that the Cedi had fallen by 30 percent within that period, international media houses such as Reuters and the Financial Times said the performance was even worse: 40 percent.

In a statement issued by Communications Minister Dr Edward Omane-Boamah Tuesday, the Government said the figures bandied about were incorrect.

“According to Bank of Ghana, the cedi traded at 2.34 against the US dollar in January 2014, and as of Friday 1st August, 2014, it stood at 3.035 to the US dollar, reflecting a cumulative depreciation of 22.9% over the period,” the statement said.

“It was also noted that the economy grew by 7.0% in 2013, instead of the correct figure of 7.1%. While the difference may seem trivial, it is important to point out the error for two reasons: (1) to promote accuracy as a matter of record, and (2) to highlight the fact that even fractional changes in an economy have significant implications,” the Government clarified.

It said: “Similarly, the Financial Times’ headline of ‘Ghana Seeks IMF Help after currency falls 40%’ also repeats some of the misrepresentations in the Reuters story, with some hyperbole too.”

“The paper makes the erroneous claim – which has since been repeated by other media houses – that the cedi is ‘the worst performing currency in the world in 2014.' Subsequently, some commentators have twisted this headline to say that Ghana’s economy is the worst in the world, despite strong positive growth across all sectors of the economy last year and so far this year.”

According to the statement:

As proof, the Financial Times adds that the cedi’s fall is “a bigger slide than even the war-ravaged Ukrainian hryvnia and the Syrian pound". What it failed to mention was that unlike Ghana, which for decades has had a market-determined floating exchange rate regime as well as a liberalised capital account (which allows unhindered repatriation of profits), Syria has a fixed exchange rate regime, with capital controls. Ukraine also maintains a “managed float” regime, after years of a fixed rate regime that artificially kept the currency strong. Therefore, any comparison across these three currencies is misleading, at best.

The fact that one Ghana cedi, as of 3rd August 2014, could buy 29.5 US cent, while one Syrian pound could buy less than one US cent, and one Ukrainian hryvnia bought only 8 US cents is positive proof that the Ghanaian economy is fundamentally strong and has bright medium term prospects despite its short-term challenges. We are working assiduously to address these in a "Home Grown" fiscal consolidation plan that we have already submitted to the IMF.

We wish to assure all journalists, both local and international, that our doors are always open for them to fact-check their stories with relevant sector ministries before they publish them. This would do as much good for their reputation as it would the quality of discourse that often relies on their stories.

News

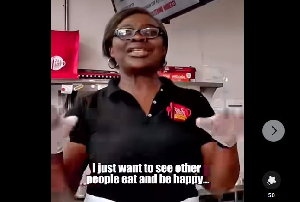

Canada-based Ghanaian woman wins heart of disguised rich 'beggar' after she offered him free pie

Sports

Thomas Partey, Inaki Williams set for Black Stars return after missing Nigeria, Uganda friendlies

Entertainment

Mahama assigned security protection to me and Oppong Nkrumah when we were criticizing him - A Plus

Opinions