Business News of Thursday, 10 June 2010

Source: GNA

Central Bank Governor calls for stringent risk management practices

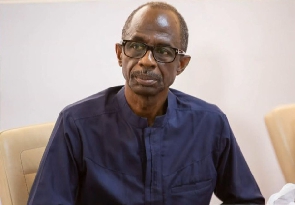

Accra, June 10, GNA - Board of Directors of Banks must establish goo d risk management practices at senior levels with direct reporting to a committee of the Board to ensure effective monitoring and control of risk in their operations, Mr Kwesi B. Amissah-Arthur, Governor of Bank of Ghana, said on Thursday.

Speaking at the launch of Ghana Banking Survey 2010, Mr Amissah-Arth ur said Boards and senior management must ensure that their risk appetite wa s held in check and quality of risk management practices was not compromise d. The Survey is a joint collaboration of PricewaterhouseCoopers (PwC) and Ghana Association of Bankers (GAB). It aims to provide general information on Ghana's formal banking sec tor and the performance of banks operating in the country for the period betw een 2007 and 2009.

The methodology analyses the published financial statements of banks , that is information already in the public domain, and draw conclusions ba sed on parameters such as asset size, deposit liabilities, profitability and capital adequacy.

"Poor risk analysis could have a debilitating effect on banking operations. Ignoring the dangers of credit, market and operational risks even in a situation of high capital can be problematic. Banking is not simply deposit mobilisation and lending. "Banking is about risk analysis and strategic deployment of funds to

earn commensurate returns at minimal risk. It is not about bigger balance

sheets or the fastest growing banks, although size and growth rate are important dynamics in banking," he said. Mr Amissah-Arthur who spoke on the topic, "Risk Management in well Capitalised Banks," said risk management should not be confined to only senior level management but be made an enterprise-wide process, involving

all levels.

"Top management is responsible for putting in place a well-defined ri sk governance framework and formulating the appropriate risk strategies. At the operational level, the roles of business units are to ensure that key ris ks are appropriately identified, assessed and mitigated".

"Risk management is a dynamic and iterative process, not a one-off exercise. It is a continuous cycle; hence there should be genuine awarene ss, ownership and accountability for risks throughout the organisation," he said. Mr Amissah-Arthur said the BOG programme requesting banks to shore u p their capital was a right step as this would make banks more resilient an d bring about healthy competition in the industry.

In addition, re-capitalised banks would have the potential to accelerate the rate of economic growth and development of the country. However, he said, to ensure that the synergy it promised was fully realised, and to avoid future challenges, adequate steps should be taken to entrench good risk management practices in banks.

"The need for strong, well-capitalised and viable banks is undersco red by the fact that the banking industry is one of the few sectors in which shareholders' funds are only a small proportion of the liabilities that banks hold. This, therefore, provides the necessity for the strong regulation of the banking sector," the Governor said.

He said well capitalised banks were better placed to finance the lo ng term development needs of the Ghanaian economy and businesses and also invest more in training and development of manpower. Mr Amissah-Arthur asked the banks to focus their attention on the n eed to increase their in-house capacity for risk analysis in the emerging oil

and gas sectors. "For banks to be effective in the new environment, they have to restructure their targets to reduce unnecessary risk taking, and reduce t he motivation for fraud". "Banks need to realise that high targets lead to higher risk taking which can result in higher profits but this may not necessarily result in

better performance".

"Undue risk taking, buoyed by unrealistic targets or the wrong incentives, exposes depositors and creditors to unnecessary risk and can wipe out capital very rapidly. Banks should therefore evolve strategies t o attain high performance within acceptable risk levels," he added. Mr Amissah-Arthur said regulators had to sit up and become more proactive in the discharge of their regulatory functions, saying it was n ot enough to react to crisis; the aim must be to pre-empt them. The Governor said BoG was focused to deal with any potential crisis i n the banking sector and expected its counterparts, the Securities and Exchange Commission (SEC) and the National Insurance Commission to also re-position themselves for the challenges that was ahead for a well capitalised financial system.