Harry Graphic Blog of Tuesday, 17 February 2026

Source: Harry Graphic

NDC Government’s Cocoa Sector Reform Robust; the Opposition NPP Mismanagements Cause of Crises and Farmers Woes

In the heart of Ghana's economy, the cocoa sector stands as a pillar supporting over 800,000 farming households and serving as the nation's second-largest export after gold. Yet recent turmoil in this vital industry has exposed deep-seated issues, largely traceable to the gross mismanagement under the previous New Patriotic Party (NPP) administration.

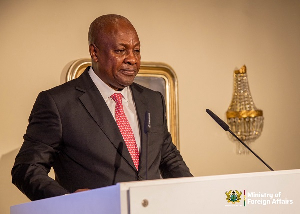

As the National Democratic Congress (NDC) government under President John Dramani Mahama rolls out robust reforms to stabilize and revitalize the sector, it is clear that the farmers' woes stem not from global market forces alone, but from avoidable policy blunders and trading miscalculations during the NPP's tenure from 2017 to 2024. The opposition NPP's attempts to criticize these reforms reveal their lack of understanding of the situation, resorting instead to cheap politics and propaganda to deflect blame from their own failures.

The NDC government has historically proven to be the true champion of cocoa farmers, delivering tangible benefits that far outstrip the NPP's record. Under previous NDC administrations, farmers enjoyed free fertilizer distribution, cocoa scholarships, cocoa road construction, and a cocoa rehabilitation program that boosted production volumes, and a commitment to paying up to 70% of the world market price, measures that directly enhanced livelihoods and sector sustainability. In contrast, the NPP's era was marred by unprecedented deviations in crop forecasts, massive financial losses, and a failure to secure farmer payments, leaving a legacy of debt of GH¢5.8 billion, road liability worth GH¢ 4.35 billion and and distrust from investors and the private sector.

Today, the NDC's decisive actions are restoring confidence, with reforms that address liquidity crises, promote value addition, and ensure fair pricing. These include the immediate payment of arrears to farmers, the introduction of an automatic price adjustment mechanism guaranteeing at least 70% of gross FOB prices, and a shift to domestic cocoa bonds for financing, ending the unsustainable syndicated loan model that collapsed under NPP watch.

Praise is due to the current NDC government for these good reforms, which mark a new chapter in Ghana's cocoa industry. Announced by Finance Minister Dr. Cassiel Ato Forson on February 12, 2026, the package includes converting GH¢5.8 billion in legacy debt owed to the Ministry of Finance and Bank of Ghana to restore COCOBOD's balance sheet, transferring GH¢4.35 billion in road liabilities to relevant ministries, and mandating that at least 50% of cocoa beans be processed locally starting from the 2026-2027 season. The revival of state-owned entities like the Produce Buying Company (PBC) and Cocoa Processing Company (CPC) will prioritize indigenous participation, while a US$500 million World Bank facility will fund agricultural roads including cocoa roads, relieving COCOBOD of non-core burdens.

These measures, coupled with the adjusted producer price of GH¢41,392 per tonne (GH¢2,587 per bag) reflecting 90% of the achieved gross FOB of $4,200 per tonne, cushion farmers against global price drops while injecting liquidity for expedited payments. For the first time in history, as noted by Dr. Peter Boamah Otokunor, farmers are receiving over 90% of the FOB price, a historic achievement under H.E John Dramani Mahama NDC leadership.

Challenging the NPP's thinking and understanding of these challenges is essential, as their propaganda ignores the root causes they themselves created. Oforikrom MP Michael Kwasi Aidoo rightly described the sector's difficulties as a "self-inflicted problem" resulting from missed opportunities to lock in high prices through forward sales during the 2023-2025 surge, when global prices peaked at $13,000 per tonne. Under NPP governance, Ghana sold only 82% of its cocoa between March and August 2025, leaving 50,000 to 70,000 tonnes exposed to price crashes, a "business wrong" and "wrong calculation" that led to unsold stockpiles and revenue losses. Their overprojection of 800,000 tonnes in the 2023-2024 season against actual output of 432,145 tonnes (a 45% deviation, far beyond the typical 5-15% variance) resulted in rollover contracts of 333,767 tonnes at a low $2,661 per tonne, costing over $1 billion that could have benefited farmers. Adverse weather and supply shortages were exacerbated by NPP's early announcements of price increases, causing hoarding by farmers and buyers, disrupting deliveries, and forcing premature price hikes to GH¢3,625 per bag.

Enumerating the specific challenges under NPP rule paints a damning picture of incompetence. First, financial deterioration led to defaults on cocoa bills in 2023 and a four-month delay in syndicated loan tranches, with the first arriving only on December 22, 2023. Second, the failed buyer-led financing model in 2024 left COCOBOD without liquidity for hedging, relying on buyers unwilling to pre-finance once rollover incentives vanished. Third, excessive contract awards totalled GH¢26.5 billion from 2014-2024, with GH¢21.5 billion between 2018-2021 alone, ballooning road liabilities and unchecked expenditures. Fourth, smuggling surged in 2023-2024 due to uncompetitive prices, requiring national security interventions as neighbours like Togo offered double Ghana's $3,100 per tonne. Fifth, the NPP sold free fertilizers procured by the prior NDC government in 2016-2017 at GH¢80 per bag, undermining farmer support. These missteps, not global forces, drove the sector to the brink, with COCOBOD inheriting a "dire financial state" including a defaulted $70 million bridge finance. Sixth, the NPP left over 200 containers of jute sacks and agrochemicals stranded or unaccounted for at Ghana's ports, causing severe shortages, bean quality decline, delayed operations, emergency replacement costs, lost export revenue, and significant direct financial losses to the state.

Calls for the sacking of COCOBOD CEO Dr. Randy Abbey, as demanded by the NPP Minority including Kojo Oppong Nkrumah on February 12, 2026, are reckless and irresponsible, amounting to nothing more than political theater. Why should he be sacked when he is not the cause of the cocoa sector challenges? Dr. Abbey has transparently admitted pricing gaps costing sales, reversed smuggling through competitive adjustments, and navigated the inherited mess of unsold beans and uncompetitive pricing. His leadership has shifted focus to making Ghana's beans marketable again, contrasting sharply with the NPP's era of massive losses and delays. Sacking him would only disrupt ongoing reforms, playing into the opposition's agenda of deflection.

To truly address these woes, the government must prosecute the NPP officials in charge of COCOBOD during their tenure, as directed by Cabinet's call for a concurrent forensic audit and criminal investigation into the past eight years. Figures responsible for the $1 billion rollover loss, GH¢26.5 billion in inflated contracts, and the unprecedented 45% forecast deviation must face accountability. The Attorney General's probe should uncover how $800 million from the 2023-2024 syndication vanished without trace, and why 333,000 metric tonnes went undelivered.

In conclusion, the NDC's robust reforms demonstrate a commitment to farmers that the NPP never matched, turning crisis into opportunity through home-grown solutions endorsed by groups like the Cocoa Farmers Alliance of Africa. As Ghana moves toward greater local processing and financial stability, the NPP's propaganda must be seen for what it is: a desperate bid to obscure their mismanagement. Cocoa farmers deserve better—and under NDC, they are getting it.

The Writer: Julius Karl D. Fieve is an innovative Gender and Development Finance Expert over 12 years of experience driving impactful initiatives across Africa. He is also a rice farmer, cultivating over 200 acres of rice in the Central Tongu District of the Volta Region. Julius holds master’s degrees-an MSc in Africa and International Development from the University of Edinburgh, UK, an MSc in Economics and BSc. Actuarial Science, both from the Kwame Nkrumah University of Science and Technology (KNUST).