On January 1, 2026, Ghana embarked on a landmark journey towards a more transparent and efficient tax system. The recent VAT reforms represent a strategic shift from the old “Flat Rate” and “cascading” models towards a standard and unified regime. While any major policy change can spark debate, it is essential to look beyond the surface numbers to understand the material benefits these reforms bring to the Ghanaian economy.

The Efficiency of the Standard Rate

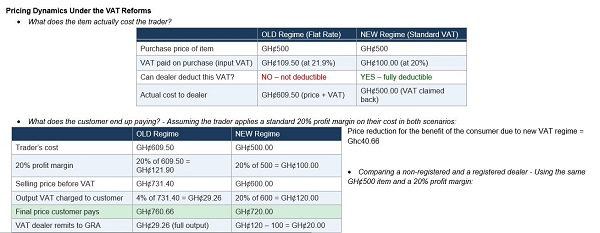

A common misconception in the marketplace is that moving from a 4% flat rate to a 20% standard rate automatically translates to higher prices. This view, however, only considers the output VAT (the tax seen by the consumer) while ignoring the transformative changes to input VAT (the tax paid by the business / taxpayer).

Under the previous system, many traders operated under a regime where the VAT they paid on stock was not deductible. It became a permanent cost, hidden within the purchase price. Under the current VAT reforms, the 20% VAT paid by a registered business / taxpayer on its purchases is fully deductible. This means the tax is no longer a cost to the business / taxpayer; it is a credit they claim back.

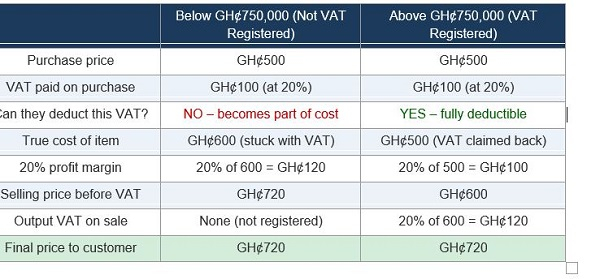

• Comparing a non-registered and a registered dealer - Using the same GH¢500 item and a 20% profit margin:

As demonstrated above, because the business no longer “absorbs” the input tax as a cost, the starting point for pricing is significantly lower. When correctly applied, the VAT reforms lead to a price reduction for the consumer, not an increase.

Ending the “Tax-on-Tax” Effect

One of the most significant achievements of the VAT reforms is the elimination of cascading taxes. Previously, some levies were applied on top of other levies, resulting in a hidden “tax-on-tax” effect that increased the final price.

The new structure “re-couples” these levies, calculating the VAT, NHIL, and GETFund on the same base value. Furthermore, by making the NHIL and GETFund components deductible for registered businesses for the first time, the government has removed nearly 18% of embedded tax costs from the supply chain.

A Fairer Playing Field: The Registration Threshold

The reforms have increased the VAT registration threshold to GH¢750,000. This move is intended to relieve micro and small enterprises of the administrative burden of tax filing, allowing them to focus on growth.

Crucially, this does not create a price disadvantage for larger, registered businesses. While a non-registered trader does not charge VAT at the point of sale, they also cannot claim back the VAT they pay to their suppliers. In contrast, a registered business operates from a lower cost base because they recover their input tax. In a competitive market, both types of businesses should arrive at a similar final price for the consumer, ensuring market neutrality.

Correcting Transitional Pricing Errors

If consumers are seeing price hikes, it is often due to double-counting. Some businesses have kept their old prices (which already included hidden, non-deductible taxes) and then added the new 20% VAT on top.

To align with the reforms, businesses should:

• Recalculate costs: Remove the VAT paid on purchases from your cost base.

• Apply margins correctly: Add your profit margin to the VAT-exclusive price.

• Utilize the credit system: Claim your input tax credit through the standard monthly returns process.

Conclusion: A Modern Tax for a Growing Nation

The VAT reforms are designed to be fairer, simpler, and more transparent. By reducing the overall effective rate from 21.9% to 20% and abolishing the 1% COVID-19 Health Recovery Levy, the government has provided tangible relief to both the private sector and the general public.

The Ghana Revenue Authority (GRA) is committed to supporting all businesses through this transition. As such all stakeholders are encouraged to engage with the GRA and use all available digital tools to ensure their pricing models reflect the benefits of this new, lower-cost tax environment.

Opinions of Monday, 16 February 2026

Columnist: Ghana Revenue Authority