Searching for Clues

Ghana, during 11-year reign of Provisional National Defence Council, PNDC, led by Chairman Flt-Lt Jerry Rawlings was one of the countries in Africa that Prof. Robert H. Bates cited as “resource rich” with a “control regime” which disenfranchised majority of its citizens by proscribing existence of political parties, among other unproductive policy choices. The PNDC was an authoritarian military regime that usurped the political power of the state of Ghana through a coup d’etat, and ruled the country from Dec. 31, 1981 to Dec. 1992.In a presentation at Johns Hopkins University’s School of Advanced International Studies, SAIS, Washington, DC, on Friday, April 13, Prof. Bates emphasized that for Africa to see the end of the tunnel, with respect to low economic growth, “Control regimes must be toast” (i.e. such regimes must be a thing of the past). Prof. Bates, a distinguished political economist at Harvard University, spoke on "The Political Economy of Africa's Growth 1960--2000 an Analytic Survey.”

Prof. Bates’ presentation was a preview of findings from teams of researchers cloistered around Africa, working in tandem with their counterparts in the United States and Europe, who have hunkered down, in the last ten years, seeking a breakthrough to the mystery and reality behind the sub-par growth performance of the African economy in the last fifty years, relative to the situation in other regions of the world.

Prof. Bates told his audience that the researchers have been “trying to figure out what happened” to the relatively low growth of the African economy during the past fifty years, and why. He indicated that the researchers are attempting to find out “what works and what does not” in the economic and political policies pursued by African societies.

The researchers are “engaged in understanding some of the fundamental problems” that have affected the relative low economic growth of Africa, according to Dr. Bates who is the resource person of the research project under the auspices of “the Africa Economic Research Consortium,” based at Nairobi, Kenya. Thus, the subtitle of Prof. Bates’ presentation was apropos: “Determinants of Africa’s Economic Performance in the First 50 Years of Independence.”

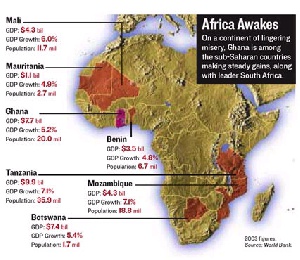

A graph representation showed that the economy of Africa had remained flat, since the 19th Century up to 1950, when the curve started to move up gradually. Yet, the upward mobility of growth of the African economy remained at the bottom of the totem pole since 1950, when compared to other regions of the world.

One significant observation from Prof. Bates’ graph was that whereas the Asian region was almost at the same level of economic performance as Africa, that region managed to pick up above Africa, since the 1950s. Earlier research had shown that “the total factor of production has been negative” for Africa, prompting the question, “what was the problem.”

Earlier in the research project, a member of the project’s co-ordination team had pushed a view that focused on the specific geographical conditions of Africa such as leaching, weathered soil, and other such phenomena as the culprits for the continent’s post-1950s poor economic growth performance. For example, Prof. Bates believes it must be possible to write the economic history of countries by looking at their rivers. However, the researchers abandoned focusing on geographic conditions as a point of departure for understanding the poor growth of the African economy.

Differences in geographic conditions notwithstanding, the low growth of the African economy was continent-wide. In other words, it was not as if the different geographic locations of African countries made a difference in economic growth patterns; low growth was the norm across the landscape of the continent.

After rejecting the focus on geographic conditions, project researchers decided not to look at Africa as a bloc, but individually, categorized on the basis of certain common characteristics: Landlocked countries; resource rich countries; or coastal/labor abundant countries, e.t.c. In general terms, landlocked African countries occupied large tracts of land difficult to manage, according to Prof. Bates.

Another general finding of the research project has been that resource rich countries in Africa went through fluctuating economic booms and bursts. Coincidentally, the coastal or labor abundant countries of Africa, presented “interesting stuff” to the researchers, according to Prof. Bates.

The coastal countries of Africa that happen to have abundant labor supply, have tended to be characterized by economic mismanagement, Prof. Bates indicated. Governments in those countries had tended to create barriers instead of opening up their economy for inclusive participation. He explained that governments in Africa that opted for socialism did not pay attention to wealth creation.

In general, “some countries in Africa were more interested in re-distribution of resources,” Prof Bates said. In the resource rich countries, benefits from economic boom periods were not saved or conserved but invested or distributed. Poor policy choices in resource rich countries of Africa have prompted the invocation of the metaphor “resource curse” by observers and some analysts.

From the political standpoint, the researchers characterized some of the African countries as “control regimes” where trade policy is based usually on import substitution initiatives and state interference in monetary policy through government manipulation of exchange and interest rates. Prof. Bates explained that “control regimes” in Africa tended not to use market forces to their advantage. Nevertheless, he indicated that African countries burdened by “state failure,” tended to suffer the highest economic growth losses, followed by those ruled by control regimes.

In African countries with state failure, social debt is paid at the back of farmers, Prof. Bates indicated.

African countries with control regimes had affinity for excessive industrial regulation; public ownership and state monopoly. Prof. Bates said control regimes in Africa had been characterized by authoritarian one-party rule that disenfranchised the majority of citizens who happen to be rural dwelling farmers.

Some control regimes in Africa ruled by the military tended not to have political parties. In those instances, “there is systematic disenfranchisement of majority of producers and consumers through authoritarianism and military rule,” Prof. Bates noted.

In the case of Ghana, Prof. Bates noted that former President Jerry Rawlings, who ruled the country as a military regime from 1981 to 1992, “fashioned rural policies to his advantage in preparation for his election as a civilian” in 1992.

In control regimes of Africa with authoritarian civilian rule, “multi-party elections may not imply political accountability” because of subversion of party competition, co-optation of the opposition, as well as the tendency for identity politics, as in voting for a politician of one’s ethnic affiliation, than on ability. Besides, voters in control regimes with authoritarian rule tended not to have adequate information about politicians and their positions on issues.

In general, “Voters in Africa don’t hold the politicians accountable,” said Prof Bates. Nevertheless, “politics changed Africa,” he observed.

When a questioner asked Prof. Bates if Africa needed to concentrate on its economy like the Asians in order to stimulate growth, he indicated there was no clear answer to the question because of the international factor in the political economy of the continent. Yet, Bates cautioned that with intelligent maneuvering, a country could extract what is good from institutions such as the IMF and the World Bank, to its economic advantage. He did not discount the fact that external policy could have negative effect on the economy of an African country. In general, Bates suggests that whereas money from outside may be politically good for African countries, they tend to be economically bad.

Prof. Bates suggested that rather than concentrate on politics, African countries would do better if they invested in their people such as through provision of education. In this instance, Prof. Bates cited the case of Ghana, juxtaposed its neighbor Ivory Coast, as well as Kenya against Tanzania. Ironically, in the case of Ghana compared to Ivory Coast, Bates noted that despite the fact that Ghana drifted towards socialism while Ivory Coast remained capitalist, “Right now Ghana is the place to be.” Ghana invested in education more than Ivory Coast, Prof. Bates noted.

Prof. Bates told the meeting in downtown Washington, DC, that the project report from the teams of researchers into the relatively low growth rate of Africa’s economy, a two-volume publication, is coming out soon.