Since the introduction of the mobile money service in the year 2009, the benefits to subscribers had been enormous.

Evolution of MoMo

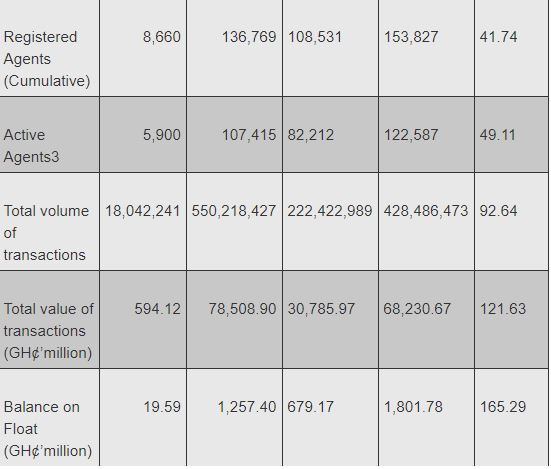

With Mobile Money which works like e-money, one can send and receive money safely, pay utility bills, TV Subscription, buy movie tickets, buy airtime, withdraw cash at merchants’ points including ATMs and pay for goods and services. In Ghana, Mobile Money is operated by 4 major Mobile Network operators, MTN (MTN Mobile Money) –industry leaders, Tigo (Tigo Cash) Airtel (Airtel Money) and Vodafone (Vodafone Cash)which has grown from a transaction value of GHC594 million in 2012 to the multi-billion cedi sector it is now. Also introduction of third party technology infrastructure in the MoMo services sector has enabled transfer of funds to and fro bank accounts through MoMo platforms.

Bank of Ghana’s Payment System Statistics on Mobile Money in Ghana revealed the constant growth of MoMo servicesas depicted in the table below makes explicit the phenomenal growth of MoMo in the country.

*Total mobile voice subscription figure is at April, 2017 (NCA)

1. Source: National Communications Authority (NCA)

2. The number of customers who transacted at least once in the 90 days prior to reporting

3. The number of agents who transacted at least once in the 30 days prior to reporting

According to a study on financial inclusion conducted by the World Bank’s Consultative Group to Assist the Poor (CGAP), Ghana’s progress on mobile money is commendable, especially as the service was introduced barely half a decade ago. According to CGAP Ghana is “the most digital financial services-ready country in Africa” when it comes to the key elements required for successful adoption: 92% of adults have the required ID necessary to open an account and 91% of Ghanaians already own a mobile phone (compared to only 74% and 72% in Kenya and Tanzania, respectively). The flipside to this sheer volume of subscribers and transactions is the increased risk for fraud due to growing expansion in “walking banks”-MoMo

MoMo Fraud

Fraud in the context of mobile money can be said to be the intentional and deliberate actions undertaken by players in the mobile financial services ecosystem, aimed at deriving financial gains, denying other players revenue or damaging the reputation of other stakeholders. The occurrence and prevalence of fraud is dependent on the stage of implementation of the mobile money service. Thus, as deployment evolves, the types of fraud evolve with it (Mudiri, 2012; Gilman & Joyce, 2012).

Types of mobile money fraud

MoMo fraud is often perpetrated by “psychopathic and sociopathic snakes”or fraudsters in the full glare of the day in a web of byzantine nature plaguing the further development of the service and duping a lot of unsuspecting subscribers, robbing them of joy in using this smart way of transacting business. Most of these fraudsters or tricksters register as MoMo agents/vendors.

The Ghana Chamber of Telecommunications, in April this year said, mobile money operators in Ghana namely, MTN Mobile Money, TigoCash, Airtel Money and Vodafone Cash have recorded 388 money fraud cases in 2016 as against 278 in 2015. Various sums of money have been made away by the fraudsters, majority of these cases have been reported to the police for further investigations and some have been successful as suspects have been tried and convicted of their fraudulent actions. Victims of MoMo fraud who have suffered from these tricksters with monies ranging from GHC70-GHC4,000 often described their experience as unfortunate.

The approaches to fraud executed by the tricksters demonstrate their thorough understanding of the mobile money system and the lacuna in the processes in place after patient studies on the behaviour of both customers and agents. Due to the recent hike in fraudulent activities by some unscrupulous persons and confident tricksters of MoMo services, it is imperative to be alert to the schemes used by these persons and with the fast increasing adoption of mobile money services, an increasing number of different types of fraud types are known to occur. Some of such possible key fraud threats and avenues to MoMo Services used by these unscrupulous persons include:

Scam Messages/Reversal of erroneous transactions: These exploitative persons (fraudsters/tricksters) send Mobile Money scam messages to subscribers with the intention of tricking them into sending funds to a designated number. Some of these tricksters use different sim cards and phones to perpetrate their fraudulent acts. Fraudsters often resort to sending fake SMS messages to subscribers’ phones (smishing) or email (phishing) alerting the customer of a cash in transaction on his mobile money wallet.

Shortly thereafter, the fraudster would call the customer claiming to have erroneously sent money to a wrong customer number. Innocently, and before checking the balance on his/her mobile money wallet, the subscriber would make a transaction to reverse the “erroneously sent money” from his account - thus losing money. This fraud is also perpetrated in a form of cooked message from fraudster bearing a supposed source from the service provider requesting you to change your PIN to reply by texting the old PIN and desired new PIN to the sender from whence the fraudsters would use your PIN at their discretion to make unauthorised withdrawals.

Emotional Delusional SMS: The fraudster sends an SMS seaming to have originated from the Mobile Money Service Provider (MNOs). The fraudsters will then call and tell the recipient that he/she the fraudster's mother is sick at hospital, he/she wrongly transferred some amount to your wallet instead to his/her sister at hospital. The Fraudster will ask the money should be returned to a named number and under the guise of emotional sympathy, the subscriber send the money without having verified the authenticity of the SMS.

Anonymous calls from fraudsters: Customers receive calls from fraudsters after deposits to transfer funds received with the claim being airtime wrongfully sent to the subscriber and often times this is not cross checked before resending by subscribers.

Cash out Fraud: Customers are pushed payment approval prompt and lured to enter their pin code in order to receive price won through Mobile Money and spoofed with authorisation SMS.

Vendor PIN Fraud: This type of MoMo fraud is usually targeted at MoMo agents especially those who have high customer traffic. It is common practice for these busy MoMo agents to initiate a transaction and then hand over his phone to the customer to punch in his number. The customer would give the phone back to the agent to complete the transaction by inserting in his PIN code. Fraudsters take advantage of this. They would go to the agent under the guise of a normal customer wanting to process a transaction, and followed the usual process. During this time, the fraudsters studied the buttons the agent pressed for his PIN code. After a few visits to the agent, the fraudsters could usually identify the agent’s PIN codes as the PIN code is a 4-figure password. The fraudster then goes to the agent to transact. This time when the agent hands over his/her phone to the supposed “customer/subscriber”, the fraudster quickly punches in a phone number, inserts the agent’s PIN code and completes the transaction. The fraudster then starts another transaction to cover his/her tracks and hands the phone back to the vendor/agent to complete it the genuine transaction.

False Promotion: This is a new tactic devised by tricksters. It works like an advance fee fraud. These tricksters run on the ambit of the fierce competition in the telcos industry which has precipitated price wars, bonuses on airtime top-up and special prizes under loyalty programmes that includes Cash, Cars, Refrigerators, Houses among others. Winners would be called through telephone calls asking them to pick up their prizes. The fraudsters are responding quickly by creating their own “call centres”. Posing as staff from the telco, these tricksters would call subscribers informing them that they were lucky winners of bogus packages and should come quickly to redeem their prizes. However, they would request the subscriber (their “lucky winner”) to make an initial deposit of mobile money to facilitate the process of hand over of the prize. Also, customers could be lured to authorize cash out transaction with the claim of winning Mobile Money promotion.

Fortuitous Scam: Fraudsters calling to dupe customers under the pretext of delivering goods from abroad (Vishing) which the subscriber never expected. Some fraudsters call and ask for specified amounts to be deposited into a mobile money account, in exchange for these goods from supposed relatives/friends from abroad.

MNO Fraud: this type of fraud is usually perpetuated by the mobile network operator (MNOs) or service provider’s employees. The victims of this type of fraud include the service provider, merchant, agent or the customer. Examples of this fraud include the service provider stealing customer’s electronic cash, unauthorized transfer of funds from customer’s account and collusion between fraudulent mobile money employees and other fraudsters to carry out unauthorized SIM swap and transactions from customers’ mobile money wallets. Employees also engage in identity theft/fraud by accessing and exploiting customer information without authorisation. Many incidents of this type of fraud have been reported in the news media across other African countries. Fraud situations for mobile network operators (MNOs) can be high; yet because of MNOs non-disclosure, the extent of fraud with mobile money is unknown.

MoMo Fraud Prevention Tips For businesses and individuals alike who are merchants, customers or subscribers to MoMo services, it is imperativeto stay alert and put in place measures which mitigate MoMo fraud.

Do not share your pin number with vendors/agents: Your PIN (Personal Identification Number) is like your password or secret code for processing of transactions. Your Pin should not be made known to the vendor or agent during transactions as this puts you at risk to fraud due to MoMo. No vendor or agent has the right to demand the private pin numbers of customers when performing a function on the mobile money platform and if you think someone has seen your pin or it has been compromised one way or the other change it immediately.

Protect your PIN: Ensure you do not chose easy-to-guess pin codes as your PIN Numbers like Date-of-Birth, Year-of-Birth, Car Number Plates, Post Office Box addresses since third parties can easily breakthrough. Additionally, memorize your PIN, Do Not write them down nor note them on your phone or in an app on your computer nor tell anyone what they are and always remember to shield your keypad when entering your PIN at any Agent point during transactions. You are encouraged to change your PIN at least every 3 months.

Confirm the identity/ name of receiving subscriber: Do a due diligence (verification) of the name of the account you are sending funds to. Don’t be outwitted by someone who says he has sent money mistakenly to your account, even if you believe their story, please check your balance first before you proceed to do any transactions. Pay attention when doing your transactions, Make sure what you type in is the name you want to type in. This is the commonest trend use by these tricksters, they call pleading that they have mistakenly sent you some money so ask you to resend it immediately. Unfortunately many fall for this without cross checking their account balance first before responding to such calls or check if payment alert received earlier has same transaction ID number as that on deposit on account confirmation.

Don't Let Anyone Carry Your Phones To Withdraw Money For You: Avoid the practice of sending third parties to cash out monies on your behalf. Some of these third parties may include friends, boyfriends, and girlfriends among other relations, could easily monitor your transactions and divert funds to other mobile money account numbers. Even if you want to send someone, ensure that you change your PIN when the phone is returned to you. If you are a vendor/agent ensure that you make an end to end transaction by yourself and avoid customer contact with agents’ phones.

Check your balance after every transaction: Check and record your balance after every transaction is completed. Also check your account balance when you receive a suspicious message. You may also call the MNO call centre to verify if the number that called you is the genuine owner of an unallocated mistaken money as there could be genuine incidence of wrong receipts of money. For vendors, they should ensure records of all transactions are done with balances after every transaction recorded so that an audit trail can be made.

Ignore suspicious calls or messages: Kindly ignore such calls and messages when you suspect them to be of a fraudulent activity. Report it to the telecommunication company to follow up and deal with the issue. The Telecommunications companies (telcos) are working closely with the e-crime bureau and the Ghana Police to clamp down on these criminals when reported.

©Stephen Enebeli Annan (CA, ACFE, BSc)

Opinions of Saturday, 7 October 2017

Columnist: Stephen Enebeli Annan