“An Investment in knowledge always pays the best interest” – Benjamin Franklin

Welcome to this new series of articles focussed on managing your wealth – Let’s talk about your wealth. Over the next few articles, we aim to start or support many of you reading this on the journey of managing, growing and protecting your wealth with useful tips and insights. Knowledge is a big differentiator for many of us on this journey to living fulfilling lives; learning from the experience and experimentation of others, so that you can either avoid (the negatives) or repeat (the positives) – that should be our goal.

We should start from the basics. To manage or grow your wealth you must make investments. The fact is, we all make investments every day of our lives. We invest our time, money and mental resources – implicitly or explicitly – by the decisions we make, defer or avoid.

Managing your wealth well is like tending a beautiful formal garden – you need to start with good soil and a good set of tools. Just as good soil has the proper fertility to nourish a plant, having the right foundation in financial literacy should empower you to potentially cultivate a successful investment portfolio through the ability to make the best-informed decisions.

Let’s start from the beginning. Before making any of your investment decisions, you should ask yourself: What are you investing for?

What are my needs and aspirations in life?

What financial goals and targets do I need to set to meet those needs?

How do I develop an investment strategy to realize these objectives?

Once you have answered these questions, you will find that investing your money according to a holistic and well-developed plan can be a rewarding experience. You will better understand how your money is working for you, and which decisions are helping you achieve your financial goals, and which are not.

It is critical to answer these questions personally and truthfully to avoid the ‘herding mentality’ that often accompanies a lot of investment decisions we make in life. We all face a largely individual life journey and this should be fully reflected in the financial decisions we make. For example, the most critical decision any one of us may make would be the decision to purchase a house. For a number of young people, this may be the largest personal expense item you may make.

It therefore follows that it should be considered carefully in the context of all the points above, as it could turn out that renting a house vs. purchasing one may serve you better, even if you can afford to purchase one outright. Or perhaps financing the purchase through a mortgage or other loan vs. self-construction.

In the area of financial investments specifically we will be covering the following 6 principles in this series in some detail to start you off/support you on your financial investment journey.

1. Assess your risk appetite

2. Diversify your investments

3. Determine your timing

4. Use averaging to your advantage

5. Start investing early and re-invest your gains

6. Regularly review and re-balance your portfolio

7. Assess your risk appetite

Your risk appetite is your tolerance level for positive and negative fluctuations within your portfolio. You need to determine whether you are comfortable with a fair amount of market volatility, or whether you prefer a calmer ride through less market volatility.

You should work with a financial advisor to detail your individual risk profile and inclinations or you can self-determine your risk profile online through the Standard Chartered Mobile Banking app or Online Banking platform. Only then can you confidently focus on investment options and strategies that suit your comfort level and financial objectives.

Risk and returns are often related, but higher risks do not automatically translate into higher returns. Riskier investments may present the possibility of superior returns, but higher risk in itself is no guarantee for good performance – they may, in fact, result in lower returns and loss of your initial investment amount.

It is important to note that achieving higher investment returns will, in most cases, require you to accept a greater level of risk in your chosen portfolio. When making your investment decisions, you should invest at a level and pace which you are comfortable with. There are many different investment strategies which you can choose from to realize your goals. The right investment decisions are the ones which are aligned to your risk profile, which includes your tolerance of risk.

Diversify your investments

You should incorporate a variety of financial instruments in your portfolio when making your investment decisions. This way, the under-performance of any single investment may be off-set by gains made on other holdings.

However, you should note that this intended off-set of losses in particular investments in gains from other investments may not always be achieved – nonetheless, this is a time proven strategy to follow. An effective way to diversify is to build a portfolio across a variety of financial instruments, such as cash, securities or derivatives, that provide exposure to a variety of financial markets and asset classes.

Types of financial markets include the following – Capital Markets (bonds and stock markets), Money Markets (short term debts like treasury bills and commercial paper), Foreign Exchange Market, Insurance Market, Commodity Market. Examples of Asset Classes and their financial instruments include the following: Long-Term Debt (bonds, loans); Short Term Debt (Treasury Bills and fixed deposits); Equity (shares/stocks); Foreign Exchange; Real Estate; Commodities (Gold, cattle/beef, soy beans, maize).

In our next article we will continue with this subject and cover the other four principles of investing in detail.

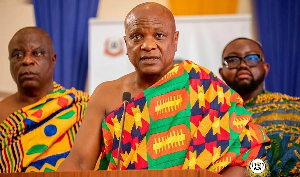

About the author

Setor Quashigah, is the Country Head for Wealth Management at Standard Chartered Bank Ghana. In partnership with asset management firms and insurance companies, the Wealth Management team provides a range of products and solutions to help our clients grow and protect their wealth. Our clients span the full spectrum, from individuals to small business and corporate clients. We have teams of Investments Advisors, Insurance Specialists and Treasury Specialists who interact with clients, and Relationship Managers who provide expert insights on global markets and specialist advice.

Opinions of Thursday, 25 July 2019

Columnist: Setor Quashigah

An introduction to the principles of investing – Part 1

Entertainment