Business News of Tuesday, 11 February 2020

Source: classfmonline.com

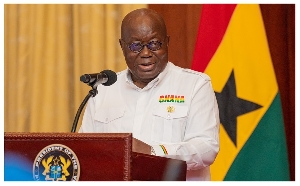

Debt accumulation rate has slowed – Bawumia

Vice-President Dr Mahamudu Bawumia has said the rate of Ghana’s debt accumulation is slowing, contrary to arguments that the rate of debt accumulation is on the rise.

Speaking at the Town Hall Meeting in Kumasi in the Ashanti Region, Dr Bawumia said: “A positive primary balance is important because when you have a positive primary balance, it means that you are slowing down the rate of debt accumulation; that is what it means … A positive primary balance means you are slowing down the rate of debt accumulation, and that means you are really implementing good fiscal management and prudent fiscal management.

“So, let us look at what has happened to the debt as a result of this fiscal discipline that we’ve imposed on ourselves and achieving the primary balance. The total public debt has increased from GHS122 billion in 2016 to GHS214 billion; that is 62.2% of GDP at the end of November 2019, but these include the cost of the banking sector clean-up, which, as we Know, is over GHS13 billion and counting. Excluding the cost of the banking sector, the debt stock stands at GHS203 billion, or 59.1% of GDP.”

The Vice-President, however, noted that the strong fiscal adjustment that has taken place coupled with better debt management has made the rate of debt accumulation slow down considerable to the lowest in a decade.

Between 2008 and 2012, the Vice-President said Ghana’s debt stock increased by 267%; and between 2012 and 2016, the nation’s debt stock shot up by another 243%.

However, between 2016 and 2019, the rate of borrowing inched up by 79%.

Ghana’s debt stock increased by about GHS86.6 billion since the Nana Akufo-Addo government came into office three years ago.

In December 2016, Ghana’s debt was GHS122, representing about 62% of GDP. This was based on the old economic value of the country.

However, at the end of September 2019, Ghana’s public debt was about GHS208.6 billion, representing 60.3% of GDP due to the rebasing of the Ghanaian economy.

The World Bank, last week, cautioned Ghana against excessive borrowing amidst concerns that the country risks being classified as a high debt distressed country if the situation persists.

This came a day after the country successfully raised a US$3-billion Eurobond which was oversubscribed by five times.

The International Monetary Fund also warned the nation that it is at a high risk of becoming a debt-distressed country.

According to the Fund, the Debt Sustainability Analysis is mainly driven by debt service to revenue exceeding the threshold throughout the forecast horizon, though all other indicators also exceed their threshold at some point over the horizon.

Entertainment