Host of Good Evening Ghana, Paul Adom-Otchere asserts that the Bank of Ghana failed to notify struggling banks as required by law before they were merged under the banner of Consolidated Bank Ghana Limited.

BoG shook the banking space, Wednesday when it announced the creation of Consolidated Bank Ghana Limited to take over five indigenous banks.

According to the Central Bank, while Royal Bank had non-performing loans constituting 78.9% of total loans granted, uniBank had a capital deficit of GHC 7.4 billion compared to the regulatory minimum of GHC 400 million.

Beige, Sovereign and Construction Banks on the other hand obtained their banking licenses under false pretenses through the use of suspicious and non-existent capital.

But Mr. Adom-Otchere says BoG did not act in accordance with some Sections of Act 930, claiming that the affected banks received no written notice from the central bank.

"The BoG said they were revoking the license of Construction and Sovereign banks under false pretenses, in that case sub sections 3 and 4 obliged the BoG to give a written notice and allow 30 days for the affected party to respond. That was not complied with by the BoG. They violated the law in that regard" a portion of his Facebook post read.

"The other revocations were done under section 123 on insolvency. Sub-section 7 of 123 prescribes that the affected parties be notified, here again the BoG did not notify them. The BoG admitted on Newsfile that they didn’t notify the affected banks," he added.

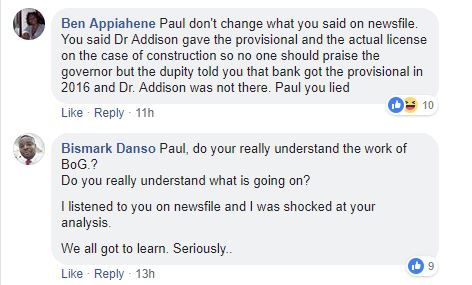

Adom-Otchere's post attracted dissenting comments with some suggesting that it was a damage control mechanism having been 'flawed' on the show by the Second Deputy Governor of BoG while others called on the banks to take legal actions if indeed there were violations.

He had argued that there was an obvious dereliction of duty by Dr Ernest Addison, BoG Governor, resulting in the closure of the five banks.

"...these things happened because of the BoG’s supervisory jurisdiction or the people that implement that were derelict in their duty..." He noted.

But the Second Deputy Governor, Dr Elsie Awadzie disagreed saying due process was followed and the Central Bank did not sleep on their job.

"It is unfortunate that people think BoG did something unlawful...that is not the case, the Central Bank will not take such a difficult decision without due regard to the law," she responded.

Meanwhile, government has made GHC450 million available for the Consolidated Bank as starting capital and has named Daniel Addo as its CEO.

GHc400 million capital requirement struggle

The Bank of Ghana gave banks in Ghana until the end of 2018 to raise a GHC400 million new capital requirement or risk being shut down, becoming a microfinance or savings and loans institutions.

Whereas the foreign-owned banks are not complaining, the local ones had asked BoG to give them some time to recapitalize.

They also petitioned the Presidency to intervene on their behalf but the central bank among other things advised them to join forces and recapitalize or risk having their licenses revoked.

General News of Monday, 6 August 2018

Source: www.ghanaweb.com