The Bank of Ghana (BoG) has noted that the use of electronic means of payment went up due to the partial lockdown of Accra and Greater Kumasi following the Coronavirus outbreak.

The lockdown led to the decline in cash transactions, the central bank said.

President Nana Addo Dankwa Akufo-Addo, as part of his measures to tackle the COVID-19 in Ghana placed restrictions on the movements of person in these areas in the country.

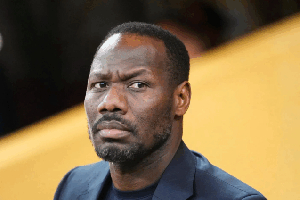

At the Monetary Policy Committee (MPC) meeting in Accra on Friday May 15, the Governor of the BoG, Dr Ernest Addison, said the lockdown resulted in a decline in currency as consumers resorted to the use of electronic modes of payment.

“General economic uncertainty reduced demand for credit, as commercial banks tightened their credit stance. As a result, credit to the private sector remained virtually flat during the period.

“Broad money supply (M2+) slowed significantly to 13.5 percent in March 2020, compared with 21.6 percent growth a year ago,” e said.

Regarding the viability of the banking sector of the local economy, he said : “The latest stress tests conducted in April 2020 suggest that banks are strong and resilient and are well-positioned to withstand mild to moderate liquidity and credit shocks on the basis of strong capital buffers and high liquidity positions.

“Capital Adequacy Ratio is well above the revised regulatory floor of 11.5 percent. However, the industry NPL ratio has inched up during the quarter, reflecting the emerging impact of the pandemic on low credit growth and higher loan provisioning.

“So far, banks are also responding positively to the recently-announced policy initiatives to support the economy by reducing lending rates and supporting credit growth, as well as offering moratoriums on loan repayments to cushion customers.”

Business News of Sunday, 17 May 2020

Source: laudbusiness.com