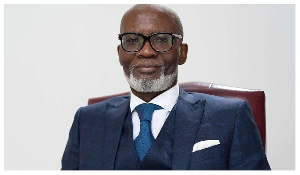

Lecturer at the Economics department of the University of Ghana, Dr Adu Owusu Sarkodie has raised concerns about the need for Ghana to setup up a body to audit its public debt.

This the economist believes will aid in reducing the country’s rising debt stock.

In an exclusive interview with GhanaWeb, the economist called for a body made up of domestic and international experts to undertake the audit, as well as analyse all the terms of loans and their costs and benefits.

To reverse the country’s debt dynamic, the executive director also stressed the need to strengthen domestic revenue mobilisation by increasing tax revenues from large companies and rich individuals, as well as cease granting tax waivers.

He said reversing the country’s debt dynamics would require a credible and sustained fiscal consolidation underpinned by strong revenue mobilisation and prioritisation of government expenditure in favour of capital and social spending.

“Paying serious attention to revenue mobilisation should, therefore, be the number one priority of the government. A revenue mobilisation strategy that seeks to strengthen revenue administration, improve tax compliance, help combat abuses and corruption, and increase the fiscal space for public investment and social spending is what is urgently needed,” he noted.

Deepening the domestic debt market

Dr. Sarkodie also pointed out the need to deepen the domestic debt market.

“While the government’s debt re-profiling initiative aimed at extending the maturity period of some short-term debts and maintaining a prudent degree of risk is commendable, one should not lose sight of the associated debt servicing costs. At the end of the day, the crucial factor is the cost of servicing the debt (interest payments) over the maturity period, which may not necessarily be cost effective,” he added.

Ghana’s public debt

Sharing an insight into the country’s debt position, Dr. Sarkodie said the situation had seriously worsened in recent years and the country now faced a high risk of debt distress and increased overall debt vulnerability.

He revealed that total public debt-GDP ratio dropped sharply from 113.1 per cent in 2000 to 26.2 per cent in 2006, driven by Heavily Indebted Poor Countries (HIPC) and Multilateral Debt Relief Initiative (MDRI) reliefs.

By end of 2016, he said the debt-GDP ratio had risen again to 73.3 per cent, and moving towards the ratios recorded in the pre-HIPC period.

“As a result, total public debt service-to-revenue ratio (including payments on external and domestic debt) has not only assumed a rapidly increasing path but has breached its indicative long-term threshold,” he mentioned.

Business News of Thursday, 16 January 2020

Source: www.ghanaweb.com