Following the successful renegotiation of the loan secured for the construction of Terminal 3 (T3) at the Kotoka International Airport (KIA), government is resolved in its quest to further reduce the cost of the loan, even as those who contracted it in the first place are defending the rate at which it was originally taken.

However, the facts of the issue that both sides, in typical fashion are seeking to score political points out of the conduct of a state-owned asset

Minister of Aviation, Joseph Kofi Adda has said, “Government has had to renegotiate the interest down to Libor plus 5 percent which is still not enough and so we continue to look for ways to bring it down even lower.”

The credit facility, he reveals, was contracted at a floating interest rate of LIBOR (London Inter-Bank Offered Rate) plus 8.5 percent.

However he has taken this financial negotiation into the realm of politics by adding that “In the recent, past, we have had exaggerated or bloated costs and the use of expensive money to carry out projects. In some cases, we have had very high interests rates on loans such as the loan used for the Terminal 3 Construction,” Adda said.

Calling the attention of the heads of agencies in the sector, the Minister pointed out the need to protect the public purse as far as public procurement is concerned.

The Loan facility, he frets, has amounted to strangulating the Ghana Airport Company Limited (GACL), preventing it from taking up more projects freely as its revenues are being held by a third-party agent to service and retire the loan.

However, the immediate past CEO of GACL, Charles Asare, has rebutted the Minister’s assertions claiming that the loan was actually taken at LIBOR plus 5.5 percent, and since at the time the loan was contracted LIBOR was 0.56 percent, this adds up to a borrowing rate of 6.06 percent. He argues that at the time there was nothing wrong with the rate negotiated since government itself was issuing Eurobonds at LIBOR plus between 8.5 and 9.7 percent at the time.

Therefore it appears the problem has arisen out of the ongoing rise in LIBOR – which currently stands at 2.38 percent – which, even at a spread of 5.5 percent would take the rate on the loan to 7.88 percent. If the Minister’s assertion is correct then the applicable rate is currently 10.88 percent.

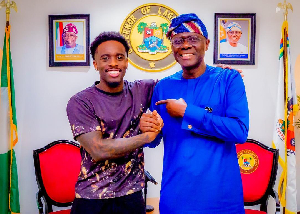

Kofi Adda, Aviation Minister

Either way though, it means GACL is now paying a higher rate than that at which government itself issued its last tranche of 10-year Eurobonds, last year, at 7.62 percent a and this justifies the need to renegotiate the rate downwards.

But Asare claims that GACL was indeed in the process of negotiating hedging contract with Barclays Bank, Stanbic Bank and Ecobank, with a view to capping the benchmark LIBOR rate at the 0.56 percent at which it stood when the loan was originally taken.

He further claims however that those negotiations were discontinued by his successor at GACL following the change of political administration in 2017.

Therefore, he concludes, all the criticism directed at the original pricing of the loan is a deliberate effort to discredit the previous administration.

On the other hand though some financial analysts are questioning the veracity of Asare’s claim that GACL was already negotiating an interest cap before the change of management in 2017, arguing that such a cap should have been part of the original loan negotiation if it was indeed on the cards at all. This argument implies that the claim is simply an afterthought aimed at justifying the original negotiations.

In the face of the ongoing back and forth however, financial commentators agree on one thing: with the Minister and Asare each claiming a different original premium over LIBOR, one of them may not be telling the truth.

The Terminal 3 project was funded by a US$274 million loan facility secured for the project, partly funded by a US$120 million loan facility from the African Development Bank (AfDB).

Business News of Saturday, 9 March 2019

Source: goldstreetbusiness.com

Controversy erupts over GACL loan

Entertainment