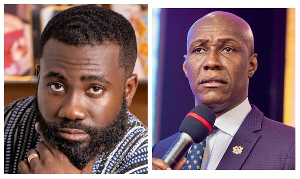

Error-prone regulation and hostility by the Bank of Ghana (BoG) are leading to the collapse of local banks and the killing of investor confidence, Member of Parliament (MP) for Bolgatanga Central, Isaac Adongo, has said.

The opposition lawmaker is of the view that the emergence of Dr Ernest Addison as the Governor of the Bank of Ghana (BoG) and the forcing out of the former Governor and his Second Deputy Governor “marked the beginning of an error-prone and antagonistic regulatory regime that has eventually, succeeded in bringing our local banks on their knees”.

His comments follow the collapse of five local banks which were later fused together to form the Consolidated Bank Ghana Limited.

The five struggling banks are: The Beige Bank, Sovereign Bank, The Royal Bank, uniBank and The Construction Bank.

In a statement on Thursday, 9 August 2018, the legislator accused Dr Addison of engaging in a conduct “detrimental to the sector they are expected to regulate and promote. It is sometimes difficult not to conclude that these are deliberate”.

Mr Adongo pointed out that it was important to understand that the work of a central bank Governor and a central bank is akin to that of a medical surgeon.

“Very high standards of precision and certainty is required. The margin of error is intolerably low because there are no second chances. Whilst an error on the part of a surgeon could lead to death, that of a Governor and a central bank in addition to deaths, could lead to job losses, destruction of careers, high fiscal costs that could impoverish lives, as well as loss of assets and financial investments of millions of Ghanaians. It is, therefore, a disaster to have an error-prone Governor and Bank of Ghana”.

Listing some examples to buttress his point, Mr Adongo explained that in just a little over a year, the central bank, under Dr Addison, issued two final licences for Construction Bank and Beige Bank and “goes ahead to personally launch them with pomp and pageantry and turns around to collapse both of them in a year. How did you conclude that their provisional licences should be confirmed? What due diligence did you do to establish that they had met the conditions precedent to a final licence? So, when Dr Addison takes only two major decisions to assure the banking public to place a reliance on his issued licences, he comes back in a year to say he got both of them wrong? That is 100% margin of error. Can you continue to entrust your life to this surgeon? This surgeon will kill more patients for each day he’s allowed to practice”.

He added: “In 2017, Dr Addison and the Bank of Ghana swooped on UT Bank and Capital Bank and handed them over to GCB Bank in a dubious Purchase and Assumption transaction. At the time, he assured Ghanaians that it was the last time we were going to have to witness a bank collapse. He also assured us that staff of UT/Capital Banks were going to be employed by the takeover Bank. What has happened? Five additional Banks just collapsed under his watch. From two Banks to seven Banks in just a year? What margin of error is this? Over 2000 former UT/Capital Bank staff have lost their jobs as GCB Bank itself has been turned into a liquidity nightmare. Again what margin of error is this? We are in the hands of a reckless surgeon who has an intolerable high margin of error waiting to kill all of us”.

Furthermore, he said: “In 2017 after the BOG collapsed UT and Capital Banks which heightened systemic risks and dipped confidence in the Banking Sector, Dr Addison announced the next day that something worse was about to happen. 272 rural community banks and micro finance companies were going to collapse. To date this has not happened. What type of Governor will do this to the industry he regulates? Feed the market with an overdose of negative sentiments at a time the industry is down and need positive information more than ever. This was at a time Banks were expected to attract more investments to meet the GHc400m minimum capital. Which investor will bring local banks this money in this state of the industry?”

Mr Adongo accused Dr Addison and the BoG of having consistently put up a posture that has worked against the local banks’ ability to raise money to meet the new minimum capital.

These, he explained, have taken the form of either confidence-dipping actions or deliberate lack of guidance on critical criteria for mergers, acquisitions; and fit-and-proper persons’ expectations.

He said in April 2018, Dr Addison indicated that he will publish the list of banks that were unlikely to meet the minimum capital in July – six clear months to the deadline.

“At the time, I indicated that his conduct was akin to disconnecting a life support machine from a patient whose samples had been sent to a laboratory for analysis to enable the Dr find a solution to save his life. At the time, I asked him of BoG’s guidelines on mergers and acquisitions, to guide the market. Clearly, the BoG was in an indecent haste to see the back of our local banks”.

The MP said: “The BoG only issued its guidance on mergers and acquisitions as well as Fit and Proper Person guidelines last month with only five months left to the deadline. So, is it possible for any meaningful due diligence, valuation of proposed merger banks, negotiation of mergers and acquisitions as well as structuring of such deals and meeting of shareholding obligations of same to be done in five months? If any bank had concluded a deal with an investor to bring in money to meet the minimum capital before BoG’s issuance of its fit and proper person guidelines and those investors are now not compliant with these new guidelines, can they conceivably find a new investor in five months to comply? Clearly, BoG has set the conditions for the local banks to fail to meet the deadline so they can be collapsed”.

He, therefore, concluded that: “The conduct of BoG has scared away investors from the banking sector with only four delicate months left. Ghana has had many smooth recapitalisation regimes in the past but the level of hostility, antagonism and regulatory gymnastics being experienced with this recapitalisation are shocking and alien”.

Business News of Thursday, 9 August 2018

Source: classfmonline.com